Should I Stay or Should I Go Now?

Kevin

8 years ago

Featured Answer

Sort by:Oldest

Comments (28)

gbauer48

8 years agolast modified: 8 years agoUser

8 years agoRelated Discussions

Should it stay or should it go now?

Comments (4)Mommyfox, Did you check your first post on this shrub? We guessed photinia and I feel pretty confident that's what it is. I just cut one down, not because I didn't like it, but because the previous owner who planted it and several other trees had no concept of how their ultimate size and location would impact other trees or the house. I had a forest of trees right up on the house! And one was a photinia which is extremely hardy, fast growing, prolific, with pretty rusty red leaves. It grew to about 12 feet. So if you want to keep it in that location you might want to move your shed a few feet over to the right now, before it gets any bigger. Or you can trim it back every couple of years to keep it more of a shrub. I'll bet you've seen them around, used as privacy hedges. The roots tend to run very deep and hang on for dear life, so it might be difficult to move even at this stage....See More'Should I stay or should I go' Red Fig (pics)

Comments (3)I was kinda thinking that too, it has been really wet here and I think water collects on the top of some of my containers and drains in...the potting mix I used this year was soaked too, a bag probably weighed 80 pounds. thanks for the reply ChefMark...See MoreShould it stay, or should it go?

Comments (6)Canina hasn't really been used as a root stock in the uk for a long time. It is possible that it was rootstock, one of the gardens down the road from me has standard roses on a thorny rootstock, (I can tell because I wince at the suckers everytime I walk past the house!) but more likely it's a birdsown wildling - I have one growing up through a rhododendron, and I like the effect, so it stays. Given that you say it's got ambitions to colonise the path already, I suspect that might be a checkmark in the remove column, given the increased light, food, water that comes with you actively tending the garden, it's likely to get more and more octopus-y as time goes on....See MoreShould I stay or should I go?

Comments (16)maackia(Zone 4): If you are really putting this up to a vote, my vote is to keep it. But then, I prefer the "wooded look" to the "formal" look. I go for the majesty of a big old tree rather then something exotic with perfect form. If you decide to take it down later, you can always do it later. Only reason I can see to do otherwise is of you need to clear the space to plant a replacement, or if the tree looks much worse in person. davidrt28 (zone 7): Didn't notice your question. White pine look amazing in the woods up here. I've seen great looking rows of old white pine along the property lines of old farms and parks. Young white pine look great in suburbs. Old ones in suburbs can be problematic. In the woods they kind of screen each other from the wind, and no one much cares if they drop branches. In the open they are more vulnerable to wind, and people freak out if a tree near the house drops branches. A white pine grown in the open can go through an "ugly duckling" phase while they decide whether they really need to lose those lower branches (as they would in the woods) when they have all that light. The transition from the perfect Christmas tree to the majestic limbed up forest giant can look homely if you have to see it out your kitchen window every day. Also they are just too big for most suburban lots....See MoreKevin

8 years agogbauer48

8 years agolast modified: 8 years agochisue

8 years agocpartist

8 years agoUser

8 years agolast modified: 8 years agosteve_o

8 years agolast modified: 8 years agohandmethathammer

8 years agoelpaso1

8 years agolast modified: 8 years agoUser

8 years agolucy132

8 years agolast modified: 8 years agoKevin

8 years agolast modified: 8 years agoweedyacres

8 years agobry911

8 years agolast modified: 8 years agochisue

8 years agobry911

8 years agolast modified: 8 years agoUser

8 years agolast modified: 8 years agotete_a_tete

8 years agojakkom

8 years agonosoccermom

8 years agolast modified: 8 years agocpartist

8 years agonosoccermom

8 years agomidwest gal

8 years agocpartist

8 years agobry911

8 years agolast modified: 8 years agomidwest gal

8 years ago

Related Stories

LANDSCAPE DESIGNGarden Overhaul: Which Plants Should Stay, Which Should Go?

Learning how to inventory your plants is the first step in dealing with an overgrown landscape

Full Story

REMODELING GUIDESShould You Stay or Should You Go for a Remodel? 10 Points to Ponder

Consider these renovation realities to help you decide whether to budget for temporary housing

Full Story

PAINTINGHelp! I Spilled Paint on My Clothes — Now What?

If you’ve spattered paint on your favorite jeans, here’s what to do next

Full Story

LANDSCAPE DESIGNEnergy Now: Designing a Garden That Gets You Going

Serenity has its place, but a garden that recharges and motivates you can be a beautiful thing

Full Story

LIFEYou Said It: ‘Just Because I’m Tiny Doesn’t Mean I Don’t Go Big’

Changing things up with space, color and paint dominated the design conversations this week

Full Story

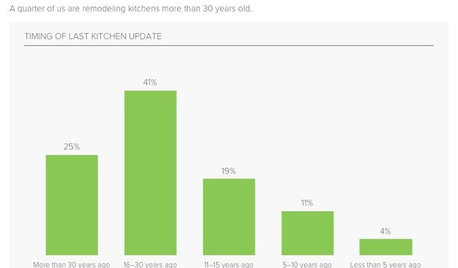

KITCHEN DESIGNSurvey Results: Kitchen Trends That Seem Here to Stay

More than a third of respondents in Houzz’s annual kitchen trends report now have the means to remodel. Here’s what else they told us

Full Story

HOME TECHWatch It! New Cameras Let You Video Chat, Stay Secure and More

Wouldn't it be great to have a single camera for home security, checking pets, chatting online and making videos? Now you can

Full Story

KITCHEN DESIGN9 Kitchen Color Ideas With Staying Power

Stick to these classic color combinations for a kitchen that will never go out of style

Full Story

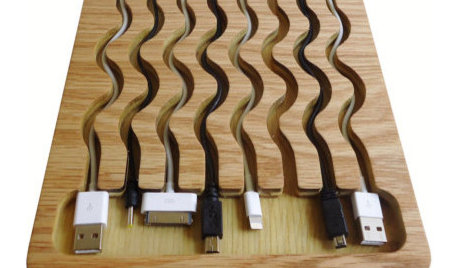

PRODUCT PICKSGuest Picks: Stay Charged

It’s power to the people with the coolest smartphone and tablet chargers, stations and cord organizers on the block

Full Story

User