Affordable Housing Market? For Whom?

georgiamomma

17 years ago

Related Stories

HOUZZ TOURSHouzz Tour: Paula Coldiron's Affordable Elegance

Author of Two Ellie Shows How To Go Family-Friendly Without Sacrificing Style

Full Story

ARCHITECTUREDesign Practice: The Basics of Marketing Your Business

Pro to pro: Attract clients and get paying work by drawing attention to your brand in the right places

Full Story

Affordable Finds for College and Beyond

Outfit Your Place With High Style From Big-Box Stores, Garage Sales and More

Full Story

RUGSFlea Market Find: Vintage Kilim Rugs

These popular floor coverings work well in every room of the house

Full Story

PRODUCT PICKSGuest Picks: 19 Kitchen Upgrades for When You Can't Afford an Overhaul

Modernize an outdated kitchen with these accents and accessories until you get the renovation of your dreams

Full Story

KITCHEN COUNTERTOPSKitchen Counters: Tile, the Choice for Affordable Durability

DIYers and budget-minded remodelers often look to this countertop material, which can last for decades with the right maintenance

Full Story

MATERIALSThe Most Popular Roofing Material is Affordable and Easy to Install

Asphalt shingles, the most widely used roof material in the U.S. are reliable and efficient, and may be right for you

Full Story

KITCHEN DESIGNKitchen Sinks: Stainless Steel Shines for Affordability and Strength

Look to a stainless steel sink for durability and sleek aesthetics at a budget-minded price

Full Story

MOVINGTips for Winning a Bidding War in a Hot Home Market

Cash isn’t always king in a bidding war. Get the home you want without blowing your budget, using these Realtor-tested strategies

Full StoryMore Discussions

peppermill

westranch

Related Discussions

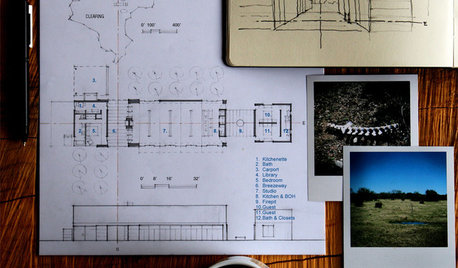

STRUGGLING to build an affordable, energy efficient house

Q

Interesting house on the market.

Q

An offer to purchase when house not on the market

Q

Vintage photos to market house

Q

cordovamom

Sully6

georgiamommaOriginal Author

Sully6

allboyz

georgiamommaOriginal Author

kellyeng

jaynees

acdesignsky

cordovamom

novahomesick

brickeyee

acdesignsky

chrisdoc

sweet_tea

feedingfrenzy

acdesignsky

jy_md

westranch

Pipersville_Carol

feedingfrenzy

feedingfrenzy

acdesignsky

feedingfrenzy

acdesignsky