Is Anybody Following The Markets?

triciae

15 years ago

Related Stories

MIDCENTURY STYLEFollow One Man’s Midcentury-Mailbox Dream

An ill-fitting mailbox leads a determined dad on a quest — and possibly to a new business

Full Story

ACCESSORIESHow to Really Score at the Flea Market

To snag the best deals from arrival to departure, follow these tried and true guidelines from an insider

Full Story

EVENTS5 Big Trends From This Week’s High Point Market

Learn the colors, textures and shapes that are creating a buzz in interior design at the market right now

Full Story

ACCESSORIESHigh Point Market Branches Out Into Natural Decor

Branches, driftwood, shells and sustainable materials were big trends in decor items at the 2012 High Point Market. Take a peek here

Full Story

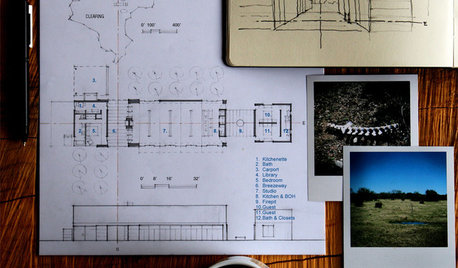

ARCHITECTUREDesign Practice: The Basics of Marketing Your Business

Pro to pro: Attract clients and get paying work by drawing attention to your brand in the right places

Full Story

MOVINGTips for Winning a Bidding War in a Hot Home Market

Cash isn’t always king in a bidding war. Get the home you want without blowing your budget, using these Realtor-tested strategies

Full Story

PRODUCT PICKSGuest Picks: 19 Standouts From High Point Market

Let these metallic and nature-loving pieces inspire a spring decorating makeover and a bright outlook

Full Story

DECORATING GUIDESTop Design Trends From the Winter 2015 Las Vegas Market

Interior designer Shannon Ggem is tracking finishes, motifs and design combinations at the 2015 show

Full StorySponsored

Professional Remodelers in Franklin County Specializing Kitchen & Bath

punamytsike

maggie2094

Related Discussions

Ava Missouri Farmer's Market, can anybody help me?

Q

Does anybody know anybody....

Q

anybody have World Market furniture?

Q

Anybody feeling queasy about the stock market?

Q

triciaeOriginal Author

Gina_W

partst

maggie2094

Terri_PacNW

beanthere_dunthat

bunnyman

Gina_W

caliloo

maggie2094

dedtired

sheesh

punamytsike

bunnyman

lpinkmountain

loagiehoagie

caliloo

caliloo

bunnyman

loagiehoagie

caliloo

bunnyman

punamytsike

triciaeOriginal Author

triciaeOriginal Author

caliloo

triciaeOriginal Author

bunnyman

bunnyman

triciaeOriginal Author

triciaeOriginal Author

triciaeOriginal Author