Buying "up" in house post-retirement

jewelisfabulous

2 years ago

Featured Answer

Sort by:Oldest

Comments (70)

Susan L

2 years agoElmer J Fudd

2 years agoRelated Discussions

Home office - follow up on posts

Comments (18)Hi Jessica and Anne, Funny, my DH wanted to clad it in wood, too. But I don't want to hide that it's a file cabinet, i want it to look like a nicer, maybe vintage file cabinet. That said, we do have some scraps left over from our wide plank floors, and I am thinking that it would be nice to use as a top for the cabinet, to bring a wood tone to that side of the room. Great minds think alike! We bought paint to match the trim and bookcases, and plan to paint it. I really wanted to use skeleton keys with a backplate, but Anthropologie no longer sells them! (see below). I used them on some of kitchen cabs and I think theyd have looked great here, but c'est la vie. I like the ones you linked too, but the opening is 5 1/2". so I can't use those. I ordered the ones linked below, hopefully they will work! I got them in a dark bronze finish, to echo the anthropologie hardware on the bookcases (http://www.anthropologie.com/anthro/product/shopsale-decorative/A22665178.jsp Oooh, i love that chair. But mine is a leather high back swivel with goose neck arms ... not sure I can give up the comfort for that style... sigh Thanks, SueB, Deedee, Pork and Kitchen! Here is a link that might be useful: in bronze.....See MoreNeed advice on buying vacation/future retirement home close to be

Comments (21)To clarify some things about our ideas to buy on Isle of Palms - while we're going to hold off on buying, and may not ever buy on the island itself, the area around it seems to be exactly what we're looking for our retirement years. The island is less than 13 miles to downtown Charleston, and only 20 miles to the Charleston Int'l airport. Even closer than Charleston is Mount Pleasant, about 4 miles away (across the Inter-coastal waterway and a marsh), which has plenty of shopping, restaurants, medical care including a decent hospital. In addition to wanting to live close to the ocean, we want to live near good medical care (this is most important), shopping (I'm not going to stop doing DIY projects on any home I live in until my body gives out - it's my hobby), airports, etc. I love the beach - every vacation we can we go to a beach - we've visited many of the east coast beaches over the years - I never get tired of it. My husband loves salt water fishing. We have a boat that he takes onto the Chesapeake Bay all the time to fish, and we go tubing on the Potomac River with our grown kids and grand kids (who are still very little). We've planned on retiring to as close to the (right) beach as possible for at least 20 years and I think it's safe to say that we're not going to change our mind about that between now and when we actually retire. And I definitely don't want to ever live someplace rural again - did that as child and have family still there - definitely not for me. Even if we were young I don't want to live in a place where there aren't plenty of doctors, including all types of specialists, and I don't want to live someplace, where if one of us was in the hospital, the other would have to drive over an hour back and forth. I'm honestly surprised at how many people I know who retire who don't care about that aspect at all. So - given what we know we want/need, we've been considering all the areas close to the Atlantic between Wilmington NC and Jacksonville FL. A few years ago we visited every place that even seemed to come close to what we want. But when we were looking before our income and savings were a fair amount less than they are now, and housing costs and interest rates were higher, so it limited where we would be able to afford to buy, so we didn't consider some of the areas we could afford now. And this is a retirement place we're talking about - being able to vacation in it before retirement is a bonus. We could wait until we retire to buy, but as I said in the original post, I don't want to miss an opportunity to buy while the prices are low AND the interest rates are low. But I do think we need to slow down and take our time - visit and stay there during different seasons, including the heavy tourist season, and make sure that it's what we want. We may find that living on an island/beach itself is not that great and that we should go back to what we always considered to be our only option - living on the mainland, but close to the beach. People seem to think that prices will be low for a while - I don't want to buy and then see prices drop even lower - and that interest rates will be low for a while too. So I realize that there is no rush - but I still don't want to kick myself years from now for missing any "deals of the century". I know this was long - sorry about that - but I think my first post gave the impression that the whole idea of buying at/near a beach, and this one in particular, was hurried and not thought out. While rushing into it right now is undoubtedly a bad idea, I don't think the concept of buying a home sometime soon for retirement in a few years, if the prices and interest rates are really low now, is a bad idea....See MoreHow to Sell Retirement Home

Comments (8)Hello again, mdjtlj, Haven't heard any updates, and it's been a couple of months since you spoke to us of your concerns about selling your Grandmom's property in FL. Anything new to add? I hope that my post over on KT may have brought a nibble or two, back then ... even though it wasn't up long till admin yanked it as being too commercial. In the light of the troubles over the housing market in the U.S. in general these days, do you feel that it is having a substantial impact on your property? Daughter was in negotiation over a property in Phoenix in the fall, neither willing to budge over $5,000. difference. So she returned to Toronto. Within a couple of months, maybe - three at the outside, I think, she said that a re-evaluation of the property had reduced the price by $20,000. Planning to move down there (she lived there for a few years, upwards of 10 years ago) she went down a while ago so is staying on the scene, currently. She works out of her laptop. We've had several snowstorms in the last month or so, with people around here being told to stay off of the highways yesterday - about 600 car crashes in and near Toronto, but no one killed or seriously injured. Maybe I should buy your Grandmom's place - but I'd have a problem with my house here, for my insurance says that it must be checked every three days. Maybe I could find someone who would exchange use of my houses - they spending the summer in FL and the winter in ON. Yeah - maybe! ole joyful...See MoreHelp with layout for retirement home/kitchen in Spain

Comments (5)I saw the word Spain and had to look! I'm from Sevilla, and have a lot of family in Marbella. How lucky are you to be retiring there?!! I'm not a pro, but I think your layout looks great! The only thing is perhaps why the DW isn't in the cabinet right next to the sink? I hope you keep us updated on your progress!...See MoreC Marlin

2 years agoSusan L

2 years agoarcy_gw

2 years agoAnnie Deighnaugh

2 years agolast modified: 2 years agomaire_cate

2 years agolast modified: 2 years agoMark Bischak, Architect

2 years agoAnnie Deighnaugh

2 years agomaifleur03

2 years agochisue

2 years agolast modified: 2 years agoRoyHobbs

2 years agolast modified: 2 years agomaifleur03

2 years agobry911

2 years agochisue

2 years agoartemis_ma

2 years agojewelisfabulous

2 years agolast modified: 2 years agochisue

2 years agojust_janni

2 years agomojomom

2 years agolast modified: 2 years agochisue

2 years agosail_away

2 years agomaifleur03

2 years agojust_janni

2 years agoarcy_gw

2 years agoToronto Veterinarian

2 years agoeld6161

2 years agolast modified: 2 years agocpartist

2 years agoRachel

2 years agoeld6161

2 years agoarcy_gw

2 years agochisue

2 years agoRachel

2 years agoElmer J Fudd

2 years agoElmer J Fudd

2 years agolast modified: 2 years agoyeonassky

2 years agolast modified: 2 years agocpartist

2 years agochicagoans

last yearjmm1837

last yearchispa

last yearlast modified: last yearJoseph Corlett, LLC

last yearnicole___

last year

Related Stories

MOST POPULARThe Polite House: On ‘No Shoes’ Rules and Breaking Up With Contractors

Emily Post’s great-great-granddaughter gives us advice on no-shoes policies and how to graciously decline a contractor’s bid

Full Story

LIFEHouzz Call: Show Us the House You Grew Up In

Share a photo and story about your childhood home. Does it influence your design tastes today?

Full Story

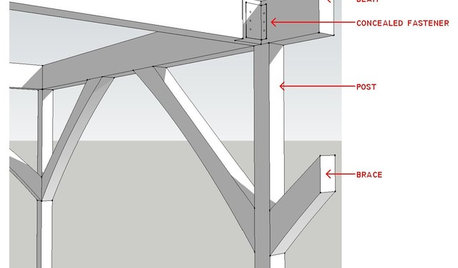

REMODELING GUIDESKnow Your House: Post and Beam Construction Basics

Learn about this simple, direct and elegant type of wood home construction that allows for generous personal expression

Full Story

MOVING8 Things to Learn From Open Houses (Whether or Not You’re Buying)

You can gather ideas, get a handle on the market, find an agent and more

Full Story

DECORATING GUIDES10 Easy Fixes for That Nearly Perfect House You Want to Buy

Find out the common flaws that shouldn’t be deal-breakers — and a few that should give you pause

Full Story

LIFE10 Habits That May Be Messing Up Your House

Start your year right by busting these clutter-inducing habits and creating a tidier interior

Full Story

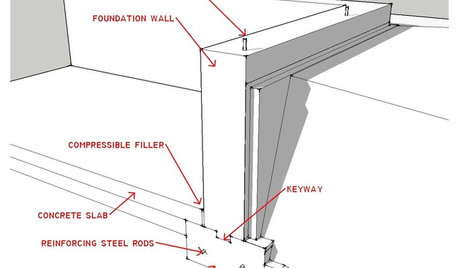

ARCHITECTUREKnow Your House: What Makes Up a Home's Foundation

Learn the components of a common foundation and their purpose to ensure a strong and stable house for years to come

Full Story

CONTEMPORARY HOMESHouzz Tour: A ’60s Ranch House Grows Up and Out

A family’s ranch house gets an addition, high ceilings and new indoor-outdoor living spaces

Full Story

THE POLITE HOUSEThe Polite House: How to Set Up an Extra-Special Guest Room

Items beyond the necessities will make holiday guests feel pampered. What extra touches would you include?

Full Story

REMODELING GUIDESHouse Planning: When You Want to Open Up a Space

With a pro's help, you may be able remove a load-bearing wall to turn two small rooms into one bigger one

Full StorySponsored

Central Ohio's Trusted Home Remodeler Specializing in Kitchens & Baths

mtnrdredux_gw