I found this a bit saddening

pkramer60

15 years ago

Related Stories

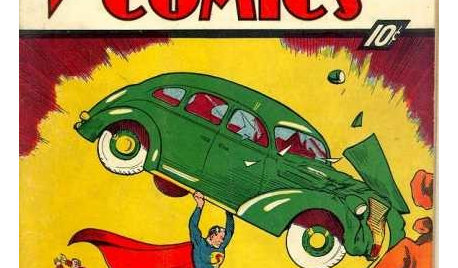

REMODELING GUIDESOne Guy Found a $175,000 Comic in His Wall. What Has Your Home Hidden?

Have you found a treasure, large or small, when remodeling your house? We want to see it!

Full Story

REMODELING GUIDESYou Won't Believe What These Homeowners Found in Their Walls

From the banal to the downright bizarre, these uncovered artifacts may get you wondering what may be hidden in your own home

Full Story

ACCESSORIESFound Objects: The Most Natural Decor of All

They're beautiful, plentiful and best of all, free. See how to turn surprise finds into uniquely personal displays

Full Story

RUSTIC STYLEKitchen of the Week: Found Objects and Old Italian Farmhouse Charm

A homeowner and her cabinetmaker create a personal version of European-inspired comfort and simplicity

Full Story

COLORBlack and White and Found All Over: Zebra Print

Don't Forget, Zebra Pattern is Made With Neutrals — Add it Anywhere!

Full Story

FRONT YARD IDEAS12 Surprising Features Found in Front Yards

Fire, water, edibles and wildlife habitats are just a few of the elements you can consider adding to your entryway landscape

Full Story

COLOREvery Room Needs a Little Bit of Black

‘I’ve been 40 years discovering that the queen of all colors was black.’ — Pierre-Auguste Renoir

Full Story

CONTEMPORARY HOMESHouzz Tour: Cool, Calm and Just a Little Bit Daring

Melbourne homeowners go for a sophisticated contemporary look in their first home as a married couple

Full Story

SHOP HOUZZShop Houzz: A Little Bit of Mexico

Curate a collection with colorful tiles, textiles and furnishings that span the centuries

Full StorySponsored

caliloo

teresa_nc7

Related Discussions

I Am A Bit Surprised At The OG Practices I See In Old Literature

Q

Can 64bit processor run in 32bit mode?

Q

Can i get a bit of feedback on a quote i received? (pics)

Q

Found out we are moving to Denver - in a bit of a panic!

Q

pkramer60Original Author

deniseandspike

mustangs81

maggie2094

gardengrl

annie1992

caliloo

claire_de_luna

dedtired

sheshebop

mustangs81

dedtired

caliloo

triciae

vacuumfreak

mustangs81

sands99

pkramer60Original Author

Gina_W

bunnyman

caliloo

sands99

jessyf

mustangs81

sheshebop

pkramer60Original Author

dedtired

dgkritch

Gina_W

girlsingardens

loagiehoagie

maggie2094

dedtired

Gina_W

triciae

triciae

dedtired

dedtired

pkramer60Original Author

dedtired

Gina_W

bunnyman