Market Expectations

mojomom

12 years ago

Related Stories

MOST POPULARTrend Watch: 13 Kitchen Looks Expected to Be Big in 2015

3 designers share their thoughts on what looks, finishes and design elements will be on trend in the year ahead

Full Story

BATHROOM DESIGN14 Bathroom Design Ideas Expected to Be Big in 2015

Award-winning designers reveal the bathroom features they believe will emerge or stay strong in the years ahead

Full Story

MOST POPULAR11 Things to Expect With Your Remodel

Prepare yourself. Knowing what lies ahead during renovations can save your nerves and smooth the process

Full Story

WORKING WITH PROSGet the Upholstery Work You Expect: 10 Details to Discuss

Avoid disappointment and unexpected costs by going over these key areas with your upholsterer before work begins

Full Story

MOVINGTips for Winning a Bidding War in a Hot Home Market

Cash isn’t always king in a bidding war. Get the home you want without blowing your budget, using these Realtor-tested strategies

Full Story

DESIGN PRACTICEContracting Practice: Marketing Your Business

To keep those projects rolling in, combine old-school techniques with the latest in high-tech networking

Full Story

VINTAGE STYLEFlea Market Find: Vintage Signs

Get the skinny on finding a vintage sign just right for your space

Full Story

DECORATING GUIDESTop Design Trends From the Winter 2015 Las Vegas Market

Interior designer Shannon Ggem is tracking finishes, motifs and design combinations at the 2015 show

Full Story

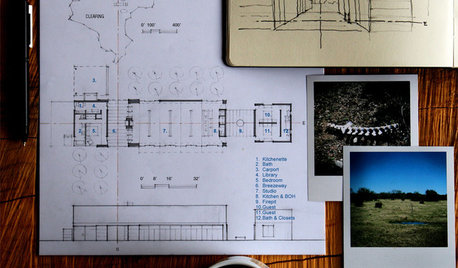

ARCHITECTUREDesign Practice: The Basics of Marketing Your Business

Pro to pro: Attract clients and get paying work by drawing attention to your brand in the right places

Full Story

OttawaGardener

Billl

Related Discussions

See you at the swap tomorrow

Q

More stock market correction expected

Q

Marketing Materials.....Marketing Plan......do you expect them?

Q

How 'off book' operations are wrecking the RE market..or

Q

chisue

chisue

njannrosen

LoveInTheHouse

kats_meow