New appraisal rules?

14 years ago

Related Stories

REMODELING GUIDESThe Dos and Don'ts of Home Appraisal

Selling your house? These tips from the pros will help you get the best possible appraisal

Full Story

HOUZZ TOURSMy Houzz: Raw Aesthetics Rule in a Toronto Family Home

Exposed plywood and beams, rough concrete and unfinished walls give the interiors a unique look — and give the family more time together

Full Story

MOVINGHow to Avoid Paying Too Much for a House

Use the power of comps to gauge a home’s affordability and submit the right bid

Full Story

GREAT HOME PROJECTSWhat to Know Before Refinishing Your Floors

Learn costs and other important details about renewing a hardwood floor — and the one mistake you should avoid

Full Story

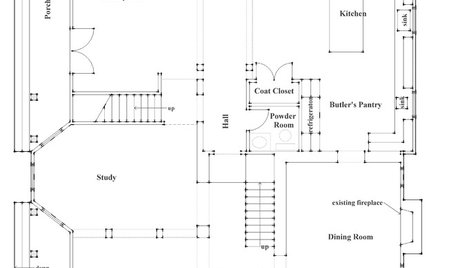

REMODELING GUIDESHow to Read a Floor Plan

If a floor plan's myriad lines and arcs have you seeing spots, this easy-to-understand guide is right up your alley

Full Story

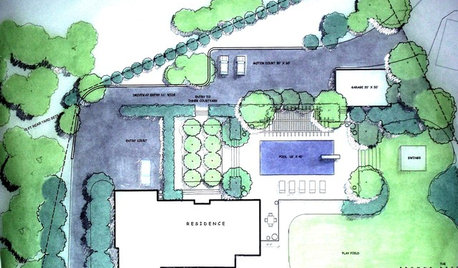

CONTRACTOR TIPSHow to Calculate a Home’s Square Footage

Understanding your home’s square footage requires more than just geometry

Full Story

KITCHEN DESIGNHow to Work With a Kitchen Designer

If you're ready to make your dream kitchen a reality, hiring a pro can ease the process. Here are the keys to a successful partnership

Full Story

MOST POPULARHow to Create an Inventory, Whether You're Naturally Organized or Not

Documenting your home items is essential, even if disaster seems unimaginable. And it may be easier than you think

Full Story

ORGANIZINGHow Much Stuff Is Enough?

Play the numbers game to streamline your belongings, for a neater home and a less-stressed you

Full Story

SELLING YOUR HOUSEFix It or Not? What to Know When Prepping Your Home for Sale

Find out whether a repair is worth making before you put your house on the market

Full Story

dave_donhoff

Nancy in Mich

Related Discussions

How do Appraisals Work on Building a New Home?

Q

Re-Certifying Appraisal at Closing

Q

New Home Appraisals

Q

New York Sues Real Estate Appraisal Firm

Q

jakkom

lyfia

jrdwyer

dave_donhoff

herusOriginal Author