Is there a loan out there for me?

TinkerTart

12 years ago

Related Stories

SHOP HOUZZShop Houzz: Take Me Out to the Ballgame

Get design inspiration from the great American pastime

Full Story0

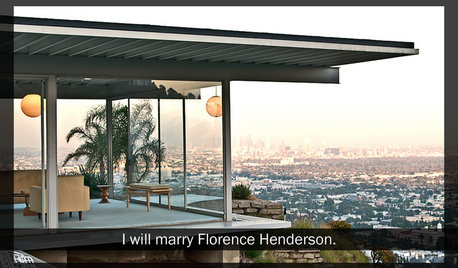

COFFEE WITH AN ARCHITECTMike Brady Lied to Me

Why "The Brady Bunch" is a terrible guide for the architectural profession

Full Story

ECLECTIC HOMESHouzz Tour: Perfection Just Out of Reach in an Eclectic Colonial

Design objects, antique finds and hand-me-downs mingle in this designing couple’s inviting — and ever-evolving — Massachusetts home

Full Story

CONTRACTOR TIPSContractor Tips: 10 Remodel Surprises to Watch Out For

Know the potential setbacks before you start to save headaches and extra costs in the middle of a renovation

Full Story

TRADITIONAL ARCHITECTUREHouzz Tour: Taking ‘Ye Olde’ Out of a Nantucket Shingle-Style Home

Vintage and modern pieces mix it up in a vacation house reconfigured to host casual gatherings of family and friends

Full Story

REMODELING GUIDESAsk an Architect: How Can I Carve Out a New Room Without Adding On?

When it comes to creating extra room, a mezzanine or loft level can be your best friend

Full Story

SHOP HOUZZShop Houzz: Give Your Mom Her Own Me-Time Room

Trick out her favorite space with pampering details and decor

Full Story0

BUDGET DECORATINGBudget Bathroom Beautifiers

Spruce up your loo without heading to the loan office, by focusing on little details that make a difference

Full Story

MOST POPULARDecorating 101: How Much Is This Going to Cost Me?

Learn what you might spend on DIY decorating, plus where it’s good to splurge or scrimp

Full Story

papergirl

azzalea

Related Discussions

are there any benefits to taking out a construction loan?

Q

Student loan consolidation loan - PLEASE help!

Q

DD#1 loaned me a book through my Kindle

Q

Does anyone have??

Q

Billl

rafor

kats_meow

brickeyee

TinkerTartOriginal Author

new-beginning

terezosa / terriks

lyfia

kats_meow

sheilajoyce_gw