Declining value of house

16 years ago

Related Stories

SELLING YOUR HOUSE10 Ways to Boost Your Home's Resale Value

Figure out which renovations will pay off, and you'll have more money in your pocket when that 'Sold' sign is hung

Full Story

MOST POPULAR5 Remodels That Make Good Resale Value Sense — and 5 That Don’t

Find out which projects offer the best return on your investment dollars

Full Story

GREEN BUILDINGInsulation Basics: Heat, R-Value and the Building Envelope

Learn how heat moves through a home and the materials that can stop it, to make sure your insulation is as effective as you think

Full Story

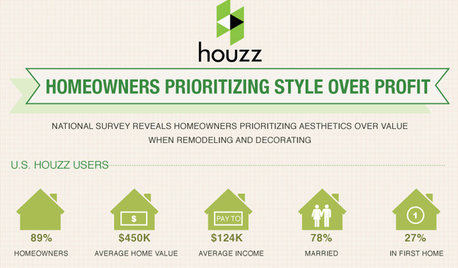

Houzz Survey: Livability Trumps Home Value

Increasing home value comes in a distant second among those planning home improvements. Many plan to do some of the work themselves

Full Story

DECORATING GUIDESExpert Talk: Portraits Take Rooms Beyond Face Value

Adding depth and intrigue, portraits also sit well with these pro designers for putting a personal stamp on interior designs

Full Story

MOST POPULARThe Polite House: On ‘No Shoes’ Rules and Breaking Up With Contractors

Emily Post’s great-great-granddaughter gives us advice on no-shoes policies and how to graciously decline a contractor’s bid

Full Story

LIFE8 Ways to Tailor Your Home for You, Not Resale

Planning to stay put for a few years? Forget resale value and design your home for the way you live

Full Story

EXTERIORSCurb Appeal Begs Your Attention

Attending to the details of your home's exterior will reap ample rewards in both allure and resale value

Full Story

GARDENING AND LANDSCAPINGWraparound Porches Have Curb Appeal Covered

Expansive covered porches add appeal and value to just about any house — and the neighborhood as well

Full Story

MOVINGHiring a Home Inspector? Ask These 10 Questions

How to make sure the pro who performs your home inspection is properly qualified and insured, so you can protect your big investment

Full Story

chapncOriginal Author

Related Discussions

Master bath remodel-what percent of home value?

Q

Figuring the value of a rental home

Q

Decline in mobile home sales

Q

Has the decline in your home's value

Q