Major Mistake on my foundation

lovins41208

14 years ago

Related Stories

DECORATING GUIDESFix Those 'Whoopsies': 9 Fast Solutions for Decorating Mistakes

Don't suffer in silence over a paint, furniture or rug snafu — these affordable workarounds can help

Full Story

BATHROOM DESIGN5 Common Bathroom Design Mistakes to Avoid

Get your bath right for the long haul by dodging these blunders in toilet placement, shower type and more

Full Story

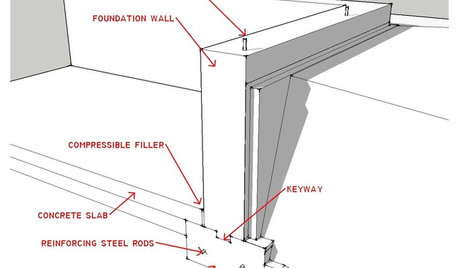

ARCHITECTUREKnow Your House: What Makes Up a Home's Foundation

Learn the components of a common foundation and their purpose to ensure a strong and stable house for years to come

Full Story

REMODELING GUIDESMajor Remodel: Restoring a Queen Anne to Glory

Misguided 1970s changes marred this Victorian-era home in Portland, until a dedicated family moved in

Full Story

BEFORE AND AFTERSHouzz Tour: A Georgia Foreclosure Gets a Major Overhaul

Gutting and redesigning turn a mishmash 1925 home into a unified haven with better flow

Full Story

HOUZZ TOURSHouzz Tour: A Portland Bungalow Gets a Major Lift

Raising a whole house allowed 5 extra bedrooms and a walk-out basement — plus a boost in income

Full Story

HOUZZ TOURSHouzz Tour: Major Renovations Aid a Usonian Home

Its classic lines got to stay, but this 1950s home's outdated spaces, lack of privacy and structural problems got the boot

Full Story

MIDCENTURY HOMESHouzz Tour: An Eichler's Interior Gets a Major Overhaul

Extensive interior work gives a 1973 home in California better flow and a brighter outlook

Full Story

HOUZZ TOURSHouzz Tour: A 1905 Cottage Gets a Major Family Update

Historic Boston meets outdoors Oregon in this expanded California home

Full Story

HOUZZ TOURSMy Houzz: Major DIY Love Transforms a Neglected Pittsburgh Home

Labor-intensive handiwork by a devoted couple takes a 3-story house from water damaged to wonderful

Full Story

phillipeh

lovins41208Original Author

Related Discussions

Major mistake!

Q

major herb garden mistake :-((

Q

UGH, think I just made a major mistake... :(

Q

Mistakes, Mistakes, Mistakes.... oh my

Q

creek_side

phillipeh

sue36

marthaelena

creek_side

lovins41208Original Author

fish7577

worthy

kangell_gw

sierraeast

sierraeast

joed

creek_side

tinycastles

lovins41208Original Author

bevangel_i_h8_h0uzz

sue36

lovins41208Original Author

sue36

sweeby

mythreesonsnc