Anyone switching from Plan F to Plan G?

dedtired

5 years ago

Featured Answer

Comments (36)

dedtired

5 years agoRelated Discussions

Greenhouse plans anyone???

Comments (4)UNless you are planning to collect rare and extremely ultratropical plants, no plant you would grow would need a round the clock winter temp of 60-70F. 70 daytime and 48-55 nighttime would be fine for most. Brugmansia actually prefer cooler temps and would be fine in a GH that was kept at 40-45F at night, but other things you had might not be happy then. Unless you are going to grow stuff like heliconias, ultratropical gingers, Episcias, maybe Taccas and some of the more tropical orchids, cold sensitive palms (most of which palms can take to the high 30's-low 40's anyway) etc you would be wasting money to heat your greenhouse to 60F at night....See More()() F A I N T I N G ()() Charlie's and my mother!

Comments (3)So... mom has asked for more Charlie's... she LOVES it!!!!!!! You can't begin to understand how unusual this is for her... to admit to liking a product that someone else told her to try... she was on the phone for about 20 minutes with me talling me all aobut her toweels and tops and sheets and no fabric softner and not ironing and she just kept up... I admit I like the stuff... but she was positively gushing about it... and btw... why don't I get bags to give to my sister and 4 sil's???? they all need to start to use this NOW too... well blow me down! Wow... positive acceptance from my mother... and it only took me 51 years to get it for something!...See MorePlanned obsolescence, anyone?

Comments (6)Let's go back to building a state-of-the-art, quality frig - that 'll last for 50 years (or more). And it seems to me that we should contact the builders to tell them that that's what we want. Rather than purposely building ones that are intended to last for 10 years - then the rich guys in the Western world (and those not so rich) need to buy replacements. And keep people working. So - let's build as many frigs as now ... but with each planned to last five times as long ... which would cost very little more per frig to produce than now, so the price for a long-life frig would not be far above the current prices. And find ways that we can help the impoverished people of the world to have the other four frigs that we built. So, for a start, I could buy a frig for me ... and one for someone in the Third World ... and still have the price of at least two more frigs left sitting in my pocket (allowing the price of the fifth frig as extra cost associated with the higher quality: which is far more than enough). We could use some of the money that we use to build military hardware ... and people to operate it - to arrange for more of that humanitarian assistance. So that less of the world's food (and we're getting really close to shortages) goes to waste. As it is ... a lot of the too-early-died frigs get hauled to the junk heap ... and junk heaps are getting bigger (shouldn't be a problem in Canada, the world's second largest country - yet our largest city found it useful to ship their crap across the border for disposal down near Detroit). Ten - twenty per cent of the world are on perpetual diet - and they say that our kids will live shorter lives because they are getting obese ... and diabetic at more youthful ages. More allergies, too. While 80% of the world often suffers hunger. We in wealthy North America had better get used to demanding quality frigs and other products, as our parents were used to ... because many of us are going to be unemployed ... or employed for lower wages, as was the situation in our part of the world until recently and is for much of the other parts of the world still. If we in the wealthy West had gained a reputation for such helpfulness, we'd have built a different and much more positive reputation in the world. It costs a lot of precious petroleum to dig iron ore, haul it to be smelted, and smelters are fuel hogs, then to flatten, shape, and assemble into the final product, then to haul to the store. And as we make more parts of the frigs, cars, etc. of plastics - the feedstock for that is precious petroleum ... or precious natural gas. We take fuel from our gas tank - to make the plastic parts for the car! Plus ... all of that burning of fuel for manufacturing and hauling causes a lot more pollution ... and global warming. Which won't cause problems for my grandkids - I don't have any. But those with grandkids should give that part of the situation some serious thought, as well. It's important for us to be much more serious conservationists. Good wishes for considering ways that you can use the world's resources more carefully and to make full use of them rather following our earlier paths of being so wasteful. ole joyful...See MoreAnyone else switch Medicare Rx plans?

Comments (1)I took Coventry's AdvantraRX Value Plan. It's $306/year and my expensive med (Advair) is $45 for a three month supply. They use Medco as drug provider, same as our plan last year, but that plan cost more and the Advair was $70 for a 90-day supply. (Advair's retail cost is $500 for 90-day supply and the patent runs to 2010.) My DH doesn't have any expensive meds (knock wood), so this year he is going 'bare'; will get his tow generic meds at Costco or Osco or Walgreens. I'm always a little nervous with a new plan until we actually SEE how it works....See Moresushipup1

5 years agodedtired

5 years agosushipup1

5 years agodedtired

5 years agosatine_gw

5 years agodedtired

5 years agolovemrmewey

5 years agoMichael

5 years agoAlisande

5 years agomare_wbpa

5 years agojrb451

5 years agoMichael

5 years agosushipup1

5 years agochisue

5 years agojoann_fl

5 years agoUser

4 years agosushipup1

4 years agoUser

4 years agosushipup1

4 years agoUser

4 years agoLars

4 years agoUser

4 years agoElmer J Fudd

4 years agoUser

4 years agoElmer J Fudd

4 years agoUser

4 years agoDawnInCal

4 years agoLars

4 years agosjerin

4 years agowildchild2x2

4 years agoLindsey_CA

4 years agoElmer J Fudd

4 years agolast modified: 4 years agochisue

4 years ago

Related Stories

GARDENING GUIDESHow to Switch to an Organic Landscape Plan

Ditch the chemicals for a naturally beautiful lawn and garden, using living fertilizers and other nontoxic treatments

Full Story

ORGANIZING7-Day Plan: Get a Spotless, Beautifully Organized Kitchen

Our weeklong plan will help you get your kitchen spick-and-span from top to bottom

Full Story

GARDENING GUIDESWhat Are Your Spring Gardening Plans?

Tearing out the lawn? Planting edibles? Starting from scratch? Tell us what you plan to change in your garden this year

Full Story

DISASTER PREP & RECOVERY5 Essential Elements of a Storm Evacuation Plan

Be ready to make a quick getaway from a storm with these tips for packing up, planning and protecting your home while you're away

Full Story

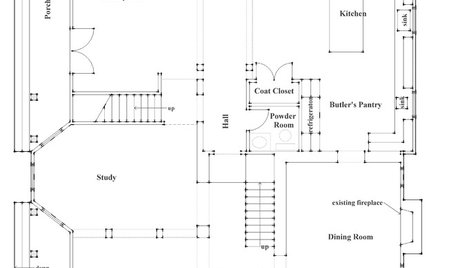

REMODELING GUIDESRenovation Ideas: Playing With a Colonial’s Floor Plan

Make small changes or go for a total redo to make your colonial work better for the way you live

Full Story

OUTDOOR KITCHENSHow to Cook Up Plans for a Deluxe Outdoor Kitchen

Here’s what to think about when designing your ultimate alfresco culinary space

Full Story

REMODELING GUIDESHow to Read a Floor Plan

If a floor plan's myriad lines and arcs have you seeing spots, this easy-to-understand guide is right up your alley

Full Story

MOST POPULARIs Open-Plan Living a Fad, or Here to Stay?

Architects, designers and Houzzers around the world have their say on this trend and predict how our homes might evolve

Full Story

ARCHITECTURE5 Questions to Ask Before Committing to an Open Floor Plan

Wide-open spaces are wonderful, but there are important functional issues to consider before taking down the walls

Full Story

LIGHTINGGet Turned On to a Lighting Plan

Coordinate your layers of lighting to help each one of your rooms look its best and work well for you

Full StorySponsored

Central Ohio's Trusted Home Remodeler Specializing in Kitchens & Baths

Anglophilia