Executor accountability

bossyvossy

6 years ago

Featured Answer

Sort by:Oldest

Comments (46)

Related Discussions

Estate Executor Information

Comments (5)If you're the executor, you'll get all the information you'll need when you file the will with the surrogate's office. I was executrix for my mother's estate. It's really very simple. You basically have to: get a tax ID # from SS, track down all the assets, put them in an estate account, pay off all debts, file the appropriate taxes, and divide the remaining assets among the heirs. When you make the distribution, you will provide the heirs with an accounting of all the money while it was in your care and you'll ask them to sign a legal document regarding the final distribution (basically stating that if any further debts surface, all heirs will give back money, in equal shares, to pay them). You can get the form from your lawyer. Then you'll notify SS that the tax ID number is no longer in use. The surrogate's office gave me all the info I really needed. I did run everything by my lawyer (I was seeing him about something else at the time), but it really wasn't necessary. The best place to start, if you have questions, would be your county store--they will have all the forms and info you need for your jurisdiction. Ours even arranged for the surrogate to come out and meet me there, so I didn't have to go into the city to file the will....See MoreResponsibilities of an executor of a will?

Comments (12)I think you have gotten some very good advice here from everyone. I don't have much to add in terms of that kind of advice as I have not been through all of this. However, it sounds as if you are truly wanting to make sure the estate is handled fairly for your remaining siblings who you DO care about. I know you said your dad is manipulative, but can you possibly set some personal boundaries and do this because it needs to be done, and done right for the future of your siblings, especially for your brother's sake? Think of it as a business transaction, your goals are to learn A, B, C, ask for D, E, F on your brother's behalf and see if he is willing to make those changes? Get in, get out, and don't look back until the time comes for you to be the executor if that is how it must be for you. It may not be easy or pain-free, but if you feel that strongly about the distribution of the estate, you may need to endure some of that pain for the comfort you would have in the end knowing it was handled fairly and your siblings are taken care of. I don't envy your position, it is difficult, but sometimes what is right isn't what's easiest. I wish you strength during this difficult time....See MoreExecutor Commission Amount?

Comments (21)Golddust- I understand the point you are making regarding my sister's responsibilities vs. mine. My sister did live in the same town as my mother and I live across country. This is always difficult. I had the burden of not being close and I lived with that guilt. I did a lot for my mother. I bought all of her clothes and sent them to her as I like fashion and it was something that I could do to help out. I worked in the medical profession for 20 plus years so I handled all of her medical affairs including insurance, prescriptions, etc. I also brought my mother to my home at least 4 times a year for a period of 2 wks. So I wasn't an absentee daughter. My sister lived in the same town as my parents all of her life and had five children. When the children were young she always had a built in babysitter and I am talking for weeks at a time when my sister and hubby would travel. So there were perks in the younger years of living close. Also, things just always magically disappeared from my mother's home and made their way into my sister's home after my mother went into assisted living. Even the diamond earrings and such that I gave to my mother as gifts from me magically disappeared. I have a picture of my mother in the diamond earrings that was taken the day before she passed and yet when I arrived home 2 days later, the diamonds were gone and nobody knows what happened to them. Hmmmm. I guess I am saying that she felt a sense of entitlement and I am now beginning to wonder when that sense of entitlement ends. I guess if I let this ride the entitlement will end now. There is nothing left. Thankfully I will never have to go through this again. Such a shame....See MoreAny other Executors?

Comments (17)I'm so lucky--no one's hassled me, nor been too over-the-top greedy. But yes, mammie--the one who did the least, who never had time to visit mom more than twice a year, was the one who had the time to run up here several times the week after mom died to load up her truck with stuff. And she was pretty perturbed when others took stuff she wanted for her 'daughter' (not a blood relative, more of a foster child, with no real ties to mom). Oh, and that sister was the one who had to take off TWO weeks from work, because she was so distraught and couldn't go in. ? ? ? (Mind you, mom was in her late 80's and had been in poor health for a number of years--her death wasn't a real shock) The rest of us managed to go on with our lives. You also find out how the deceased felt about people. Mom had her will written so that if one of us died, our children would get their share. BUT she specifically had a provision that if something happened to the above sister, her share would go NOT to her adopted foster kids, but to the rest of us. That said a lot. She had 15 years to change that, and never did. Note that one of the other grandchildren who WAS named in the will WAS adopted. Thank goodness, it didn't come to me having to deal with any of that--but I'd have had no choice but to follow the will's provisions....See Morebossyvossy

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agobossyvossy

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agobossyvossy

6 years agoschoolhouse_gw

6 years agoElmer J Fudd

6 years agolast modified: 6 years agobossyvossy

6 years agosushipup1

6 years agoElmer J Fudd

6 years agolast modified: 6 years agoschoolhouse_gw

6 years agobossyvossy

6 years agolast modified: 6 years agobossyvossy

6 years agobossyvossy

6 years agolast modified: 6 years agonicole___

6 years agolast modified: 6 years agoblfenton

6 years agoElmer J Fudd

6 years agolast modified: 6 years agoElizabeth

6 years agoratherbesewing

6 years agoschoolhouse_gw

6 years agolast modified: 6 years agoElmer J Fudd

6 years agosushipup1

6 years agoUser

6 years agoElmer J Fudd

6 years agolast modified: 6 years agoshare_oh

6 years agoChi

6 years agoquasifish

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agoraee_gw zone 5b-6a Ohio

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agonorar_il

6 years agoElmer J Fudd

6 years agolast modified: 6 years agobleusblue2

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years ago

Related Stories

ORGANIZINGGet Organized: Are You a Piler or a Filer?

Tote out the bins and baskets and learn how to be an organized piler if file cabinets leave you cringing

Full Story

DECLUTTERINGWhen Simplifying, Which Papers to Keep and Which to Toss?

Find out which records you can get rid of when you are decluttering or moving to a smaller home

Full Story

MOST POPULAR4 Obstacles to Decluttering — and How to Beat Them

Letting go can be hard, but it puts you more in control of your home's stuff and style. See if any of these notions are holding you back

Full Story

DECLUTTERINGHow to Go Through a Deceased Loved One’s Belongings

A professional organizer offers sensitive and practical advice on sorting through a loved one’s things

Full Story

MOST POPULARGet Organized: Take a 10-Day Simplification Challenge

Organizational expert Emily Ley helps us get a jump-start on our New Year’s clear-outs

Full Story

MOST POPULARBlast Decluttering Roadblocks Once and for All

Change your thinking to get the streamlined, organized home of your dreams

Full Story

ORGANIZINGHow to Manage Your Daily Mail

Prevent a snail-mail pileup by creating an efficient sorting center and reducing the mail you get. Here’s how

Full Story

ORGANIZING4 Questions to Help You Organize Your Favorite Photos

Organize your keeper photos with a system that's just right for you, whether it's in the cloud or you can hold it in your hand

Full Story

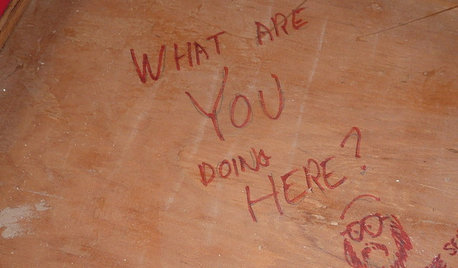

FUN HOUZZDoes Your Home Have a Hidden Message?

If you have ever left or found a message during a construction project, we want to see it!

Full Story

ORGANIZINGProfessional Organizing Tips for 6 Situations You May Face

Whether you’re remodeling, shifting into a new life stage or working from home more, this pro advice can help

Full Story

aok27502