Has this happened to you?

spf5209

13 years ago

Related Stories

GARDENING GUIDESGot Frost-Damaged Plants? How It Happens, and When and How to Prune

Crispy brown leaves are a sure sign that Jack Frost has been to your neighborhood

Full Story

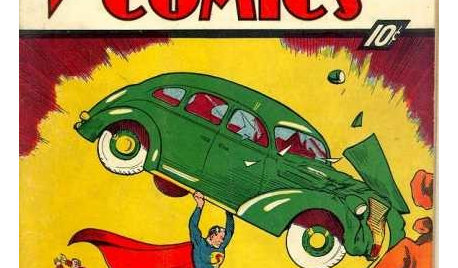

REMODELING GUIDESOne Guy Found a $175,000 Comic in His Wall. What Has Your Home Hidden?

Have you found a treasure, large or small, when remodeling your house? We want to see it!

Full Story

KIDS’ SPACESWho Says a Dining Room Has to Be a Dining Room?

Chucking the builder’s floor plan, a family reassigns rooms to work better for their needs

Full Story

COTTAGE STYLEHouzz Tour: Snug London Cottage Has a Spacious Feel

Natural light, an ingenious layout and plenty of space-saving tricks are the secrets to this compact home’s laid-back charm

Full Story

COLORS OF THE YEARPantone Has Spoken: Rosy and Serene Are In for 2016

For the first time, the company chooses two hues as co-colors of the year

Full Story

LIFEHouzz Call: What Has Mom Taught You About Making a Home?

Whether your mother taught you to cook and clean or how to order takeout and let messes be, we'd like to hear about it

Full Story

HOUZZ TOURSMy Houzz: ‘Everything Has a Story’ in This Dallas Family’s Home

Gifts, mementos and artful salvage make a 1960s ranch warm and personal

Full Story

MODERN ARCHITECTUREHouzz Tour: Arizona's Dialogue House Has Something New to Say

Get in on the conversation about this minimalist masterpiece in the Phoenix desert, remodeled by its original award-winning architect

Full Story

MY HOUZZA Light-Filled Artist’s Loft Has Touches of Home

A painter finds the perfect studio space in Seattle’s vibrant Ballard neighborhood

Full Story

HOUZZ TOURSMy Houzz: An Art-Filled Austin Home Has Something to Add

Can a 90-square-foot bump-out really make that much difference in livability? The family in this expanded Texas home says absolutely

Full Story

soesoe75

booboo60

Related Discussions

Has this happened to you?

Q

Sweet almond V. Has this happened to you?

Q

Kate, Has this happened to you?

Q

Has this happened to you yet?

Q

galore2112

sue36

pps7

worthy

periwinkle18

angela12345

spf5209Original Author

arkansasfarmchick

worthy