How long...

muddbelly

16 years ago

Related Stories

DECORATING GUIDESDivide and Conquer: How to Furnish a Long, Narrow Room

Learn decorating and layout tricks to create intimacy, distinguish areas and work with scale in an alley of a room

Full Story

KITCHEN ISLANDSWhat to Consider With an Extra-Long Kitchen Island

More prep, seating and storage space? Check. But you’ll need to factor in traffic flow, seams and more when designing a long island

Full Story

DECORATING GUIDESAsk an Expert: How to Decorate a Long, Narrow Room

Distract attention away from an awkward room shape and create a pleasing design using these pro tips

Full Story

MOVINGRelocating Help: 8 Tips for a Happier Long-Distance Move

Trash bags, houseplants and a good cry all have their role when it comes to this major life change

Full Story

FURNITUREHow to Arrange Furniture in Long, Narrow Spaces

7 ways to arrange your living-room furniture to avoid that bowling-alley look

Full Story

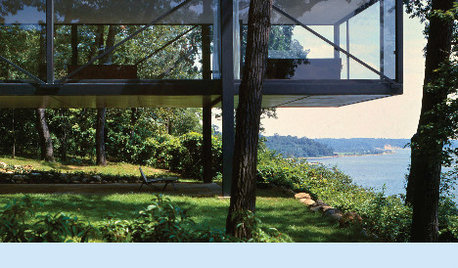

BOOKSBook to Know: 'Long Island Modernism 1930-1980'

Photographs mix with social history from the architectural highlights of Long Island's suburbanization

Full Story

FIREPLACESLong Mantels Go the Distance

Don't stop short by sticking on a candle and calling it a day. Long mantelpieces offer the chance to really stretch your style

Full Story

DECORATING GUIDESImproving a Rental: Great Ideas for the Short and Long Haul

Don't settle for bland or blech just because you rent. Make your home feel more like you with these improvements from minor to major

Full Story

GARDENING GUIDESLook for Long-Horned Bees on Summer's Flowers

These insects are busy in the garden come summer and fall, pollinating sunflowers, coneflowers, asters and more

Full Story

DECORATING GUIDESSmall Changes to Simplify Your Long-Term Storage

Conquer your attic and basement storage in more than a day, with these easy, bite-size steps for sorting, storing and protecting your stuff

Full StoryMore Discussions

chelone

User

Related Discussions

How long is too long for cut potatoes?

Q

how long oh how long

Q

How long does it take a Lacunosa to get vines this long?

Q

Pros ... How long is too long between exterior coats of paint?

Q

jakkom

joyfulguy

muddbellyOriginal Author

chisue

western_pa_luann

triciae

joyfulguy

zone_8grandma

punamytsike

chisue

kitchenshock

jakkom

muddbellyOriginal Author

saphire

Jonesy

housenewbie

Jonesy

harriethomeowner

chisue

joyfulguy

lucy

joyfulguy