Credit Card Issues

lostinit

13 years ago

Related Stories

You Said It: Hot-Button Issues Fired Up the Comments This Week

Dust, window coverings, contemporary designs and more are inspiring lively conversations on Houzz

Full Story

COFFEE WITH AN ARCHITECTAn Architect's Calling Cards

The next time you run into a tongue-tied architect hanging out solo in a corner, one of these handouts may help

Full Story

FUN HOUZZBinge on the Design of ‘House of Cards’

Pull up a seat to Netflix’s addictive political drama for sets and fashions rife with intrigue

Full Story

REMODELING GUIDESContractor's Tips: 10 Things Your Contractor Might Not Tell You

Climbing through your closets and fielding design issues galore, your contractor might stay mum. Here's what you're missing

Full Story

BLUE AND GRAY FOLIAGEGreat Design Plant: Donkey Spurge

Yes, there's the awful name, plus the sap issue. But this plant's foliage and flowers bring something special to Eastern U.S. gardens

Full Story

MOVING5 Risks in Buying a Short-Sale Home — and How to Handle Them

Don’t let the lure of a great deal blind you to the hidden costs and issues in snagging a short-sale property

Full Story

COFFEE WITH AN ARCHITECT8 Valentines From Architects

Special relationships deserve special cards. These are custom designed for love in all its glass and steel glory

Full Story

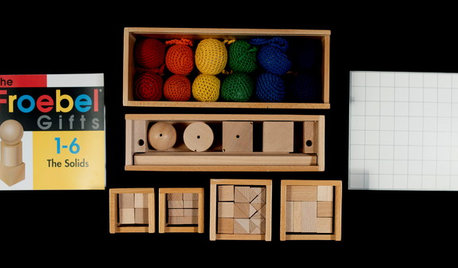

THE ART OF ARCHITECTUREToys to Inspire Budding Architects and Designers

Frank Lloyd Wright’s blocks, cards by Eames and more toys from around the globe tap into kids’ imaginations and build skills

Full Story

LIFEHouzz Call: Show Us Your Nutty Home Fixes

If you've masterminded a solution — silly or ingenious — to a home issue, we want to know

Full Story

VALENTINE’S DAY5 Relationship Problems Solved by Design

Everyday issues driving you and your special someone apart? These design solutions can help mend your together time

Full StoryMore Discussions

mike_kaiser_gw

Billl

Related Discussions

Sears blue credit card, being replaced by a master card?

Q

Bush's Bailout plan, good idea?

Q

So upset with BR furniture, con't from previous thread

Q

Returning Land's End purchases to Sears

Q

setancre

jakkom

lido

cindyb_va

lostinitOriginal Author

hilltop_gw

alouwomack

alouwomack

lostinitOriginal Author

maifleur01

Billl

lostinitOriginal Author

Billl

jollyrd

trianglejohn

davidro1

Chemocurl zn5b/6a Indiana

sherwoodva

lostinitOriginal Author

Billl

jakkom

jollyrd

dreamgarden

lostinitOriginal Author

jakkom

clg7067

GammyT

lostinitOriginal Author

maifleur01

jakkom

jollyrd

greenhousems

ian_bc_north

mike_kaiser_gw

debtgirl

MrsShayne