New Business and New Debt!!

bouncingpig

18 years ago

Related Stories

ARCHITECTUREDesign Practice: How to Start Your Architecture Business

Pro to pro: Get your architecture or design practice out of your daydreams and into reality with these initial moves

Full Story

DESIGN PRACTICEHow to Set Up Your Design Studio at Home

Learn from an architect how to create a workspace that fuels your practice and feeds you inspiration

Full Story

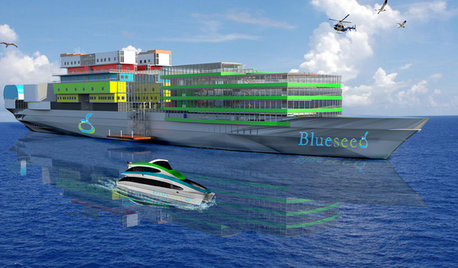

LIFECould Techies Get a Floating Home Near California?

International companies would catch a big business break, and the apartments could be cool. But what are the odds of success? Weigh in here

Full Story

KITCHEN DESIGNKitchen of the Week: Simple Lines and Bold Color

When imagining a new look for this space, the designer started with orange

Full Story

BEFORE AND AFTERSNewly Open Style Updates a Contemporary Atlanta Home

Sweat equity over seven years opens up a 1980s home for a Georgia couple who loves a challenge

Full Story

How to Fight Off Blue Monday at Home

10 ways to counteract the "most depressing day of the year"

Full Story

HOUZZ TOURSMy Houzz: Patience and Resourcefulness Pay Off in Dallas

Unhurried remodeling lets a growing family stay within budget and get exactly the look they want for their Texas home

Full Story

ARCHITECTUREDesign Practice: Getting Paid

Pro to pro: Learn how to manage contracts and set up the right fee structure for your work

Full Story

CONTEMPORARY HOMESHouzz Tour: Remaking a Penthouse in a Gothic London Landmark

Step inside a renovated luxury apartment in London’s St. Pancras Chambers

Full Story

COTTAGE STYLELessons From Camp: Cottage Inspiration for Home

Embrace the bones, and 11 other design tips from a reborn summer camp in the woods of Wisconsin

Full StorySponsored

More Discussions

steve_o

housenewbie

Related Discussions

New one called 'Monkey Business'

Q

new range for home based wedding cake business

Q

New Social Business with Focus on Permaculture

Q

Busy Tile Backsplash - New Countertops

Q

quiltglo

bouncingpigOriginal Author

steve_o

joyfulguy

bouncingpigOriginal Author

steve_o

joyfulguy

happyprocess