Financing a car: is this dumb and is there another option?

skrepka

18 years ago

Related Stories

WORKING WITH PROSHow to Hire the Right Architect: Comparing Fees

Learn common fee structures architects use and why you might choose one over another

Full Story

GARAGESKey Measurements for the Perfect Garage

Get the dimensions that will let you fit one or more cars in your garage, plus storage and other needs

Full Story

COMMUNITYGet a Bird's-Eye View of America's Housing Patterns

See the big picture of how suburban developments are changing the country's landscape, with aerial photos and ideas for the future

Full Story

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full Story

COMMUNITY15 Ways to Make Your Neighborhood Better

Does your community lack ... well, a sense of community? Here's how to strengthen that neighborly spirit

Full Story

BUDGETING YOUR PROJECTDesign Workshop: Is a Phased Construction Project Right for You?

Breaking up your remodel or custom home project has benefits and disadvantages. See if it’s right for you

Full Story

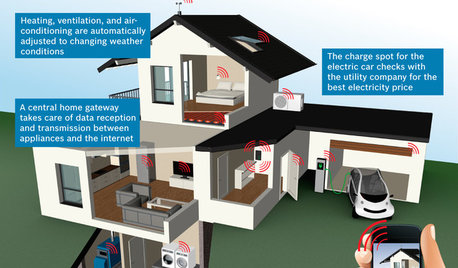

THE HARDWORKING HOMECES 2015: Inching Toward a Smarter Home

Companies are betting big on connected devices in 2015. Here’s a look at what’s to come

Full Story

FRONT YARD IDEASBefore and After: Front Lawn to Prairie Garden

How they did it: Homeowners create a plan, stick to it and keep the neighbors (and wildlife) in mind

Full Story

LIFEMake Money From Your Home While You're Away

New services are making occasionally renting your home easier than ever. Here's what you need to know

Full Story

PETSSo You're Thinking About Getting a Dog

Prepare yourself for the realities of training, cost and the impact that lovable pooch might have on your house

Full StorySponsored

More Discussions

Meghane

scryn

Related Discussions

finance options

Q

Seller Financing

Q

Question about stepchildren and finances

Q

How did you finance your remodel?

Q

skrepkaOriginal Author

Vivian Kaufman

skrepkaOriginal Author

beachmamaproperties

jlhug

steve_o

skrepkaOriginal Author

scryn

housenewbie

valtog

scryn

steve_o

cindyb_va

rosalynd

scryn

londondi

kathy_