Solar Tax Credit Advice?

Addition Planner

5 years ago

Featured Answer

Sort by:Oldest

Comments (7)

Addition Planner

5 years agolast modified: 5 years agoRelated Discussions

Do whole house fans qualify for tax credit?

Comments (2)poorowner the "circulating fan" they speak of is a high efficient or variable speed fan/blower not a whole house fan. I suggest you check the attached link. good luck! Here is a link that might be useful: Energy Star Gov Site...See MoreReplace AC only for tax credit - mix brands?

Comments (5)I have a proposal to replace my heating and air conditioning system that is 22 years old. I live in Fairfax, VA in a 2,300 sq. ft two story center hall colonial house with a brick and clapboard exterior, 4 bedrooms, 2 ý baths, and þ finished basement. The proposal includes an AHRI certificate qualifying the system for the Federal tax credit that I downloaded from its site and has the following information on it: Split system: Air-cooled condensing unit, coil with blower Outdoor model #: 4TTX6048E1 (Trane XL 16i) Furnace model #: TUD120R9V5 (Trane XV 80) Indoor model #: C(A,C,D,E)60D44+TDR (Aspen) Cooling capacity: 48,000 EER Rating (cooling): 13.00 SEER Rating (cooling): 16.50 The system and installation includes a TCONT802 thermostat, new equipment pad, removal of existing system, refrigerant evacuation and recovery, and set up of new system. No duct work. The existing electronic air cleaner and humidifier will be retained and used with the new system. Is this system a good fit and is it priced fairly? The installer has been our HVAC servicer since moving into the house 20 years ago, and is top rated for both quality and price by the Washington ConsumerâÂÂs Checkbook magazine. IâÂÂm assuming that this system will qualify for the maximum tax credit of $1,500. Can anyone confirm? Thanks....See MoreTax credit and low e glass

Comments (4)It's very likely that at this point you won't have time to order the doors and have them installed before Dec. 31, 2010. The tax credit criteria was very poorly designed. There should have been no SHG max in the Northern States and they should have allowed a U-factor as high as .35. In the South the SHG and U-factor should have been lower. The idea behind the tax credits was to lower the cost differential between very high performing windows and average performing, to encourage consumers to purchase the better performing windows. It became as simple as window manufacturers using a different piece of glass, that was designed for warmer climates, on all their windows. To answer your question, if you want the tax credit, you will have to buy a door that complies. I have never heard of a manufacturer charging less for LoE glass. I would check that out with another dealer of that brand of door. Sounds to me like they are trying to jack up the price unfairly. If you decide to go with them and also want the tax credit, I would ask for the highest solar gain available. Keep in mind that although you will likely reduce the solar gain in the winter, you are also reducing convection and conduction....See MoreCongress extends 30% tax credit for solar

Comments (0)Article today in our local paper: Solar homeowners win big in California ruling, for now SF Chronicle, January 28, 2016 http://www.sfgate.com/business/article/Solar-companies-and-customers-win-big-in-6790872.php .....Congress in December [2015] unexpectedly renewed a 30 percent tax credit for solar installations. ++++++++++ Of note for CA residents only: There are major changes to the rate agreements between the CA utilities and solar customers. There is now a substantial difference between the old 'net energy metering' (popularly known as "net zero") for existing customers along with any new installations that make it under the '5% cap' [see article link], which PG&E/Northern CA estimates will be reached by their customer base roughly around Sept 2016. After that, ALL solar installations will be under the new agreement, which are less financially attractive. This is especially true because new solar customers will be under the "time of use" rates, where different rates are charged at different times of the day. The CA PUC will revisit the issue in 2019, so even existing customers should continue to monitor this issue. It is not a given that existing solar users under the 5% cap will always be able to keep that 20-yr extension of being compensated at retail electricity rates for the excess energy they send back to the grid....See Morerwiegand

5 years agobry911

5 years agoJeffrey R. Grenz, General Contractor

5 years agoonobed

5 years ago

Related Stories

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full Story

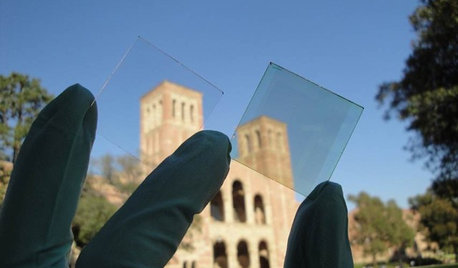

GREEN BUILDINGLet’s Clear Up Some Confusion About Solar Panels

Different panel types do different things. If you want solar energy for your home, get the basics here first

Full Story

ORGANIZINGHow to Get Your Papers Organized Before Tax Time

A professional organizer offers a manageable plan for tackling those paper piles now to make April a little easier

Full Story

GREEN BUILDINGSunlight Used Right: Modern Home Designs That Harness Solar Power

Embracing passive heating principles through their architecture, siting and more, these homes save energy without skimping on warmth

Full Story

HOME TECHSmall Solar: Big Home Tech Trend in the Making

New technology enables everyday household objects to power themselves by harnessing natural light

Full Story

GREAT HOME PROJECTSHow to Add a Solar Water Heater

Lower energy bills without a major renovation by putting the sun to work heating your home’s water

Full Story

REMODELING GUIDESHow to Protect (Even Enhance!) Your Relationship While Renovating

No home improvement project is worth a broken heart. Keep your togetherness during a remodel with this wise advice

Full Story

SMALL HOMESHouzz Tour: Sustainable, Comfy Living in 196 Square Feet

Solar panels, ship-inspired features and minimal possessions make this tiny Washington home kind to the earth and cozy for the owners

Full Story

MOST POPULARContractor Tips: Top 10 Home Remodeling Don'ts

Help your home renovation go smoothly and stay on budget with this wise advice from a pro

Full Story

HOUZZ TOURSHouzz Tour: Zero-Energy Renovated Victorian in San Francisco

A 1904 home that's entirely energy efficient? Yes, courtesy of solar panels, radiant heating and water reclamation

Full StorySponsored

Jamie