Congress extends 30% tax credit for solar

jakkom

8 years ago

last modified: 8 years ago

Related Stories

GREEN BUILDINGGoing Solar at Home: Solar Panel Basics

Save money on electricity and reduce your carbon footprint by installing photovoltaic panels. This guide will help you get started

Full Story

GREEN BUILDINGLet’s Clear Up Some Confusion About Solar Panels

Different panel types do different things. If you want solar energy for your home, get the basics here first

Full Story

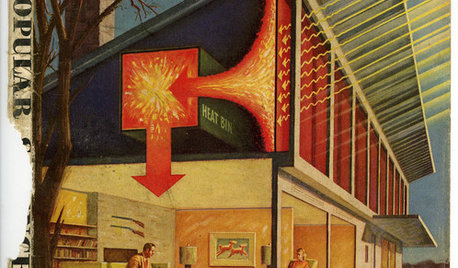

GREEN BUILDINGChampioning the Solar House, From the 1930s to Today

Homes throughout history that have used the sun offer ideas for net-zero and passive homes of the present, in a new book by Anthony Denzer

Full Story

SMALL HOMESHouzz Tour: Sustainable, Comfy Living in 196 Square Feet

Solar panels, ship-inspired features and minimal possessions make this tiny Washington home kind to the earth and cozy for the owners

Full Story

GREEN BUILDINGOff the Grid: Ready to Pull the Plug on City Power?

What to consider if you want to stop relying on public utilities — or just have a more energy-efficient home

Full Story

TINY HOUSESHouzz Tour: A Custom-Made Tiny House for Skiing and Hiking

Ethan Waldman quit his job, left his large house and spent $42,000 to build a 200-square-foot home that costs him $100 a month to live in

Full Story

GREEN BUILDINGHouzz Tour: Going Completely Off the Grid in Nova Scotia

Powered by sunshine and built with salvaged materials, this Canadian home is an experiment for green building practices

Full Story

DIY PROJECTSLight Up Your Night With an Easy Outdoor Table Lamp

Hit up Goodwill and the hardware store to make this lamp for a deck or poolside patio in minutes

Full Story

CONTRACTOR TIPSBuilding Permits: What to Know About Green Building and Energy Codes

In Part 4 of our series examining the residential permit process, we review typical green building and energy code requirements

Full Story

REMODELING GUIDESLiving Roofs Crown Green Design

Living roofs save energy, improve air, water, curb appeal — and the view from above doesn't hurt either

Full StorySponsored

Related Discussions

$6500 tax credit

Q

Tax credit on insulated garage door for new construction?

Q

Do whole house fans qualify for tax credit?

Q

stimulus plan tax credit for window upgrade

Q