Please remember the GOP is still attempting to reconcile the House and Senate tax bills. Discussions and many compromises are being debated. This is merely to alert people to keep an eye on what the final legislation produces.

Small Investors Face Steeper Tax Bill Under Senate Proposal

Senate bill would require investors unloading partial stakes in a company to sell oldest shares first

WS Journal Dec. 11, 2017

(excerpted)

A little-discussed provision in the Senate tax bill could lead to a higher tax bill for millions of small investors and cause many to unload stocks before year-end to avoid those costs.

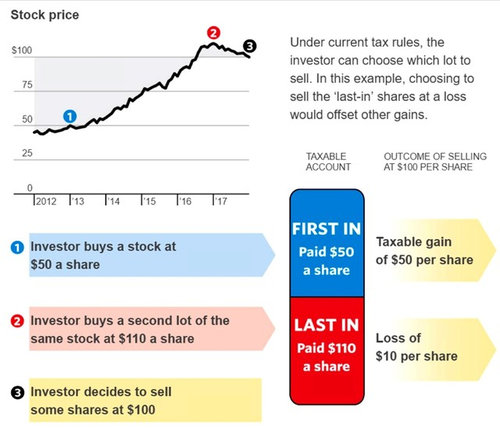

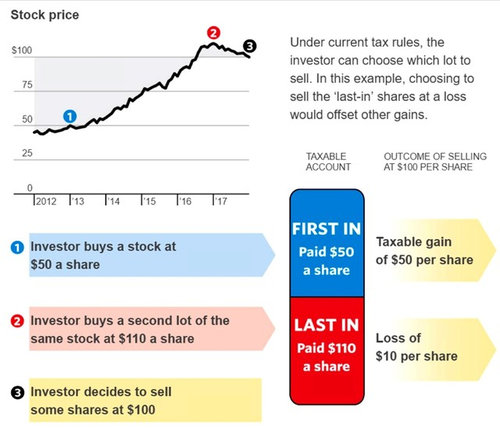

Under the Senate’s $1.4 trillion tax overhaul, investors would lose the ability to choose which shares they can sell to reduce a position. Instead, investors selling partial stakes in a company would have to unload their oldest shares first, a process known as selling on a “first-in, first-out” basis.....If the provision in the Senate tax bill takes effect, the investor would not have the option to sell the ‘last-in’ shares until all ‘first-in’ shares were sold.

Selling those shares usually brings a higher tax bill if the stock’s price has been rising. Some small investors are fuming that the new rule would cause them to pay much more in taxes.

The House’s tax proposal doesn’t include the first-in, first-out provision, and some lawmakers are trying to kill it. In a letter to Senate leaders on Thursday, 41 House Republicans urged their colleagues to drop the provision, saying it would amount to “massive, fundamental change that inhibits investor autonomy.”

Proponents point to a Joint Committee on Taxation estimate that the rule would raise as much as $2.4 billion over the next 10 years, starting in 2018. The Senate recently voted to start formal tax-bill negotiations with the House, hoping to get a final bill to the president by Christmas.

Some money managers and analysts say there has been so little discussion of the Senate provision that investors may be surprised to learn that the new rule could reduce—or even wipe out—what they would save from an income-tax reduction.

“If someone thinks their tax bill is going to get cut next year, some investors may wait until 2018 to sell stocks and then have this huge tax bill” since they will be forced to sell their oldest holdings first, said JJ Kinahan, chief market strategist at TD Ameritrade.

His firm last month sent a letter to Congress saying the proposal “inexplicably and unfairly discriminates against the typical Main Street investor using a buy and hold strategy.”

Another concern for small investors: The first-in, first-out provision will make it more expensive to perform regular portfolio rebalancing to keep their mix of stocks and bonds constant, since the provision will raise the amount of taxes they pay. “This discourages investment rather than encourages it,” Mr. Kinahen said. “That’s dangerous.”

Many investors may now sell shares in the next couple of weeks to avoid the risk of paying higher taxes, analysts say, especially those who expect to need cash in the next few years.

Take the case of an investor who owns lots of shares in electric-car maker Tesla Inc. The first lot was purchased in early 2013, when Tesla’s stock had traded at $35.36 a share. The more recent lot was purchased in June at $360.75 a share.

This investor wants to sell some of Tesla stake to withdraw cash from the market on Dec. 1, when the car marker’s shares traded at $306.53. If the Senate tax provision is going to become law, this person would be required to sell the shares bought first before selling any of the shares in the more recent lot, forcing him or her to incur a taxable gain of $271.17 per share.

But under current rules, the investor would have the option of selling the shares bought last. That would generate a loss of $54.22 a share, which could be used to offset other gains.

The provision would allow investors in funds and dividend-reinvestment plans the choice of selling at the average cost of all the shares they bought. But that average-cost method doesn’t apply when selling specific shares of a company’s stock.

Ins and Outs

A hypothetical example illustrating the tax implications of first in-first out and last in-first out accounting—or FIFO and LIFO

Embothrium

Elmer J Fudd

Related Discussions

inheritance tax - how much we will pay?

Q

Please explain property taxes after buying...

Q

Will receive a tax bill for today's out of state purchase. True?

Q

How on earth do you obtain a copy of a utility bill from 36 years ago?

Q

Embothrium

jakkomOriginal Author

Elmer J Fudd

joyfulguy

joyfulguy