When did you start planning retirement?

Annegriet

7 years ago

Featured Answer

Sort by:Oldest

Comments (38)

Related Discussions

Did you start out with a plan or let your garden evolve?

Comments (20)I guess I am a plunker. I keep buying things that remind me of something when I was a kid or is just pretty then before you know it I have 20 or 30 things in pots and have to make a new bed for them. Then I put in stuff and still don't have room for it all so what do I do? Put it in bigger pots to hold them over til I get another bed made and then go buy more, lol. My patio looks like a jungle. Oh yeah did I mention I need more beds. I am trying to talk my hubby into making me one the entire length of the back of the house and clear out the shrubs on each side. Then I want to yank out all the ugly shrubs across the whole front and make those flower beds too. Poor thing he agreed to buy this house out of all the ones we looked at because he thought he wouldn't have to plant anything since it had mature trees and shrubs already. I just said thats right and let him dream til we actually got it. Now I am slowly filling him in on the real plans I have for it all. I love my trees but hate the shrubs. Especially since he doesn't like to trim them. I would much rather have pretty plants there. This is my first house and I have been waiting a long time to have a place to plant things so I am really enjoying it. I had neck and shoulder surgery recently so I can't do my own digging or I would be done already. Sorry for the rambling post....See MoreWhen did you start having 'signs'?

Comments (8)Hi intherain, Some signs of perimenopause I only saw in retrospect. At the time, I didn't realize what was happening.....since many of my signs weren't the classic signs. I believe my immune system started getting off whack. When I was 45, I got the flu, pneumonia, ear infections, GI problems, alot of panic, headaches, sinus infections, etc. Then, when I was about 47-48, my periods got a little irregular, and I started bleeding way too much. I had to have a D&C, and was put on HRT.......which, in retrospect, may have worsened alot of my symptoms, such as GI problems, headaches, etc. I'm 55 now, and have about 1 period a year. But......when I get that period, alot of the old perimenopause symptoms come back for awhile. Life is getting much more stable and predictable for me now.....which is such a nice change! I never really got hot flashes, although I was sooooo hot my whole life, all the time....and especially when I was in my late 40's. I think most people have the classic perimenopausal symptoms, like irregular periods, hot flashes, irritability, sleep problems, but I also think some of us have symptoms that we'd never really think to associate with perimenopause. I've always heard that we tend to have the same type of trip through it all that our mothers had. Good luck, and hold on tight! ;)...See MoreWhen did you start preparing to move?

Comments (15)We commenced a month ago in preparation for an across the country move in April/May this year. At least a quarter of my beautiful basement floor is currently occupied with large bags my wife marked for charity; they will surely be bringing a large truck. As I stated in another thread, this is doing little to reduce my move volume and weight (34K+ lbs), of all the 'must-have'/'must-move' pieces here. Similar to cz_crap, we will rent a large home (I'm going to hate it) while we build the new home over 18 months. I am grouping and placing items in categories, many in open boxes, for movers to pack and mark them accordingly. I did a similar and successful move several years ago from UK to USA whence 90% of my home was in storage in the UK for a year and shipped days before and arrived precisely on the day I closed on the new house just built; while I was signing title documents at the title company, the 40' container truck arrived from NYC port, at the new home, where my daughter was waiting; truckers only had to wait less than ten minutes before before we were permited to move contents to the new property. This time it will be different, since I'm my own GC and intend to build enough to get a CO; the county is fine with that so long as the area is sealed off from the remaining constrution zone. It will be harder to get a CO from my wife who does not want to move into a 'construction zone' again. She suffered for six months while I finished my basement (6hrs/day and weekends), when I moved it's entire (1000sf of 1500sf) to the home above. I'm not dreading the move but it will surely be challenging, very expensive for home and three vehicles....See MoreWhen did you start shaving?

Comments (20)I wanted to start around 11-12, when I became aware of it and my friends started shaving their legs. I remember my mom said I was not allowed until I was 13, and she wouldn't budge on that. And I didn't dare disobey her, even though it was terrible living in California in long pants! If I have a daughter I'll let her shave her legs at a reasonable age. I've never cut myself shaving. I guess the razors now are safer? I'm cringing at some of these stories!...See MoreElmer J Fudd

7 years agolast modified: 7 years agomaifleur01

7 years agoElmer J Fudd

7 years agomaifleur01

7 years agojakkom

7 years agolast modified: 7 years agomaifleur01

7 years agoElmer J Fudd

7 years agolast modified: 7 years agomojomom

7 years agolast modified: 7 years agozippity1

7 years agojakkom

7 years agoElmer J Fudd

7 years agolast modified: 7 years agopamghatten

7 years ago3katz4me

7 years agoartemis_ma

7 years agolast modified: 7 years agoLindsey_CA

7 years agosteve_o

7 years agomaifleur01

7 years agosteve_o

6 years agomaifleur01

6 years agosteve_o

6 years agomaifleur01

6 years agoElmer J Fudd

6 years agolast modified: 6 years agomaifleur01

6 years agolast modified: 6 years agoElmer J Fudd

6 years agolast modified: 6 years agomaifleur01

6 years agoElmer J Fudd

6 years agomaifleur01

6 years agoElmer J Fudd

6 years agolast modified: 6 years agomaifleur01

6 years agoElmer J Fudd

6 years agolast modified: 6 years agojudy661

6 years agoElmer J Fudd

6 years agomaifleur01

6 years agoElmer J Fudd

6 years agojudy661

6 years ago

Related Stories

DECORATING GUIDESHow to Decorate When You're Starting Out or Starting Over

No need to feel overwhelmed. Our step-by-step decorating guide can help you put together a home look you'll love

Full Story

DISASTER PREP & RECOVERYRemodeling After Water Damage: Tips From a Homeowner Who Did It

Learn the crucial steps and coping mechanisms that can help when flooding strikes your home

Full Story

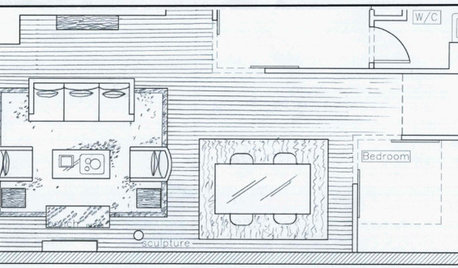

DECORATING GUIDES9 Planning Musts Before You Start a Makeover

Don’t buy even a single chair without measuring and mapping, and you’ll be sitting pretty when your new room is done

Full Story

GARDENING GUIDESGet a Head Start on Planning Your Garden Even if It’s Snowing

Reviewing what you grew last year now will pay off when it’s time to head outside

Full Story

KITCHEN DESIGN9 Questions to Ask When Planning a Kitchen Pantry

Avoid blunders and get the storage space and layout you need by asking these questions before you begin

Full Story

REMODELING GUIDESWhen Retirement Came Early, a Couple Headed for the Hills

A Seattle pair turn their part-time home into a full-time one, remodeling it to gain views and help it stand up to snow, sun and wind

Full Story

BUDGETING YOUR PROJECTHouzz Call: What Did Your Kitchen Renovation Teach You About Budgeting?

Cost is often the biggest shocker in a home renovation project. Share your wisdom to help your fellow Houzzers

Full Story

ARCHITECTURERoots of Style: Where Did Your House Get Its Look?

Explore the role of architectural fashions in current designs through 5 home styles that bridge past and present

Full Story

CONTRACTOR TIPSBuilding Permits: When a Permit Is Required and When It's Not

In this article, the first in a series exploring permit processes and requirements, learn why and when you might need one

Full Story

REMODELING GUIDESPlanning a Kitchen Remodel? Start With These 5 Questions

Before you consider aesthetics, make sure your new kitchen will work for your cooking and entertaining style

Full StorySponsored

jakkom