Power of attorney issues

deeinohio

12 years ago

Related Stories

DISASTER PREP & RECOVERYMore Power to You: How to Pick the Right Generator

If your home's electricity goes, don't let it take your necessities with it — keep systems running with this guide to backup power

Full Story

GREAT HOME PROJECTSPower to the People: Outlets Right Where You Want Them

No more crawling and craning. With outlets in furniture, drawers and cabinets, access to power has never been easier

Full Story

HOUZZ TOURSHouzz Tour: California Cabin Ditches the Power Grid

Solar energy powers a modern, expandable vacation house among the trees for a family with two children

Full Story

GREEN BUILDINGOff the Grid: Ready to Pull the Plug on City Power?

What to consider if you want to stop relying on public utilities — or just have a more energy-efficient home

Full Story

BATHTUBSRoom of the Day: Restorative Power of a Japanese Soaking Tub

A traditional tub made of hinoki wood sets a calming tone in this master bath renovation

Full Story

MOST POPULARA Few Words on the Power of Simplicity

An architect considers a pared-down approach to modern home design

Full Story

REMODELING GUIDESWake Up Rooms With the Power of Fresh Air

Even the trendiest interior designs can feel stale when your home is in permanent lockdown. Look to windows and doors for the solution

Full Story

HOME TECHPlug Into Home Power Monitors That Pay for Themselves

Stop throwing away money on wasted electricity with help from new monitors that work with your phone or computer

Full Story

LIFEHow to Prepare for and Live With a Power Outage

When electricity loss puts food, water and heat in jeopardy, don't be in the dark about how to stay as safe and comfortable as possible

Full Story

HOME TECHUnlock Your Smart Phone's Front-Door Powers

Take your locks and keys into the digital age with 3 solutions that put convenience and new capabilities on your doorstep

Full StorySponsored

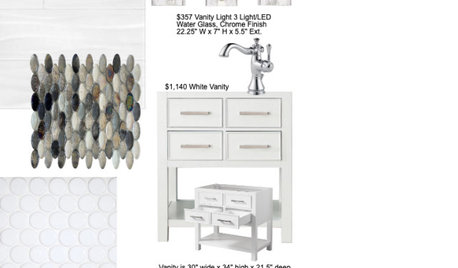

Central Ohio's Trusted Home Remodeler Specializing in Kitchens & Baths

golddust

les917

Related Discussions

Living Will and Medical Power of Attorney

Q

not a mower issue a power washer

Q

Central AC question, issue occurred after power outage.

Q

Help! New build, power line issue.

Q

deeinohioOriginal Author

deeinohioOriginal Author

suero

golddust

Olychick

Olychick

tinam61

maire_cate

tinam61

Olychick

tinam61

golddust

sweeby

camlan

deeinohioOriginal Author

golddust

tinam61

folkvictorian

paulines