Pre-medicare health insurance

3katz4me

5 years ago

Featured Answer

Sort by:Oldest

Comments (18)

jellytoast

5 years agolast modified: 5 years agol pinkmountain

5 years agoRelated Discussions

What happens when you don't have Health Insurance?

Comments (65)Late husband worked for a health insurance company, and that was the last time we had a health insurance benefit. When he left that job, we got catastrophic care insurance, with a huge deductible. We eventually opened HSAs as well. Over the last ten years, each of us has had jobs that offered health insurance plans. We looked at the cost (to the employee) of those company plans, and the benefits, and restrictions imposed. We compared them to the cost of our current plans and benefits, (when you pay yourself, you chose who you want with no restrictions). The HSA balance creeps up over time, allowing more payments, (dental, doctor's office visits, optometrist exams,) on a schedule we controlled, instead of what the company plans would allow. Employers have been hit hard the last few years, too. The workplace plans we were offered had higher premiums than our individual accounts with Unnamed Health Insurance Company, and were not of more value to us. In spite of being a "catastrophic care" policy with a high deductible, It seems to be paying for things, or making partial payments for things, every time i turn around. Tick removed from back at walk-in facility: Paid half the bill. Prophylactic medication in case I was exposed to Lyme disease: I was stunned to have the couple bucks and change it cost. I asked the pharmacist "Isn't there a minimum dispensing fee?" Yes, she said, but the insurance covers it. If I hadn't had that policy, it would have been twenty dollars or so, for two pills. As it was, I paid less than three dollars out of pocket. I'm actually quite happy with the situation I'm in: the fewer people sticking there noses into my health care (policy wonks in DC or that lady in personnel) the better I like it. And it had no bearing on Poor Late Husband's demise: He had lung cancer, quite likely from his thirty eight years of smoking two packs a day. There were unusual circumstances that contributed to his sudden death only five weeks after diagnosis. No amount of chemo, surgery etc., would have saved him. I had a cancer scare myself, actually less than three months after his passing. I asked a nurse what would happen if I had cancer, and my insurance didn't cover treatment. She said she didn't know how that worked, and she said the doctors and nurses take precautions to not know anything about the finances of patients. That way, she said, those with or without insurance are treated the same way while in the hospital. I think it's stupid to go without insurance to have more money for lattes and cell phones, but I defend others' rights to spend the money they earn in a way that they find valuable. As for people who "End up in the emergency room because they couldn't afford a doctor" I've personally known, lived near, worked with some of those people...and they abused the emergency room option so they wouldn't have to pay. I've heard them rationalize taking a child with an earache to the emergency room to avoid a $20 co-pay at the doctor's office, and the hassle of scheduling an appointment. Then in the next breath they griped that they had to wait so long to be seen....See MoreAny Seniors choosing health insurance?

Comments (2)We just went through switching DH from Secure Horizons, which is a medicare advantage plan to original medicare with Part D prescription drug plan plus medigap supplemental insurance plan. Before we did anything I spent weeks reading and digesting, trying to sort out what -- to me -- is a swamp. I am happy to share what I learned. chisue-- My DH's medicare advantage plan, which has 0 annual cost plus drug copays *is* an hmo. It's hard to generalize as these things vary from state to state and company to company. But, essentially, if an advantage plan covers you only if you see doctors in their network and only allows you to purchase drugs on their formulary then it *is* an hmo. That system worked fine for DH until he developed a rare medical problem. Then suddenly no docs took his insurance and all the consults were 100% not insured. Medicare approved supplemental insurance plans basically cover deductions, extra doctor's fees, extra hospital fees and a variety of other things such as skilled nursing, or at home care depending on what you choose. They run A (the most basic) through L or M -- each cover different things. If you only need drugs, it may be possible for you to get a drug plan under medicare Part D. Not sure how that would gibe if you are otherwise covered by your DH's insurance but medicare can tell you. They also would walk you through choosing a drug plan. It's complicated and you're basically making a best guess but they have a computer program that shows you approximately how much each drug plan costs and what it involves. Having a computer is a huge help in all this....See MoreBummed about health insurance!

Comments (36)As roarah says, all states are not equal. I live in a state whose gov. has done everything he could to stymie the ACA & refused to expand Medicaid - leaving many of our citizens w/o access to coverage. Also, our insurance commissioner is reportedly prohibited from regulating the insurance 'providers' - essentially allowing them to gouge consumers. If it were not for the ACA, I would not have insurance (had none for over 30 years before now) & I've already made good use of it. My individual plan is costing approx. $4400/yr, but I'm paying only about $800 of that w/ the subsidy. Not to let anybody off the hook, but I think the biggest culprit is medical costs - which continue to balloon out of control, it seems. Insurance providers, & ultimately we, are definitely paying through the nose for services & prescriptions. I was recently in a hospital room for about 6 hours - not even an overnight stay & no meals & the charge for that my ins. co. paid was $23,000! Has anyone else heard about the new push to require providers to disclose prices? The prediction is that this may result in lower costs - eventually. Right now, the $$ charged for a procedure can vary as much as 70% or more... http://www.npr.org/blogs/health/2014/02/12/276001379/elusive-goal-a-transparent-price-list-for-health-care Oh & love him or hate him, I recently heard a good 1 from Ralph Nader: isn't it ironic to be calling the folks who gouge everyone on medical costs 'providers'?...See MoreAnd it's time to talk about Medicare supplemental insurance again.

Comments (13)Gosh, I hate this whole procedure. I'm also seeing that medicare supplements are hugely more expensive for 2016. We've had Plan F high deductible in 2014 and 2015, paying under $100/month. Looks like more than DOUBLE for the same coverage next year -- and very little difference in premiums between high deductible and the comprehensive straight Plan F. I'm wondering if we will even GET a supplemental plan next year. I have yet to meet the deductible ($2800) after my hospital stay for pneumonia. (Medicare paid almost everything.) I'd have been better off not paying premiums! We have to do Part D (drug plan). Fun and games running the numbers of who will charge you less for any maintenance meds -- two for DH and one for me (Adviar, at $300/mo. retail). This is a cockamamie system we have in the US....See More3katz4me

5 years agolast modified: 5 years agoFun2BHere

5 years agolast modified: 5 years agoOlychick

5 years agowritersblock (9b/10a)

5 years agolast modified: 5 years agohhireno

5 years agomaddielee

5 years agoolychick

5 years agoFun2BHere

5 years agolast modified: 5 years ago3katz4me

5 years agol pinkmountain

5 years agojill302

3 years agoTina Marie

3 years agosushipup1

3 years agoBestyears

3 years ago3katz4me

3 years ago

Related Stories

ORGANIZINGPre-Storage Checklist: 10 Questions to Ask Yourself Before You Store

Wait, stop. Do you really need to keep that item you’re about to put into storage?

Full Story

MOVINGHiring a Home Inspector? Ask These 10 Questions

How to make sure the pro who performs your home inspection is properly qualified and insured, so you can protect your big investment

Full Story

HOME TECHWhat If Your Home Could Make Sure You Stayed Healthy?

New research could make this a reality sooner than you think

Full Story

HEALTHY HOME4 Ways to Create Healthy Habits at Home

Do these things to your home to make it easier to get enough sleep, exercise regularly, eat right and relax

Full Story

ROOFSHow to Get Your Roof Fixed

Leaky roof? Missing shingles? Here are the basics for tackling that roof repair

Full Story

LIFE7 Tips to Get With a New Minimalist Mentality

Feeling overwhelmed by your stuff? Here's how to pare down, simplify and keep just what you need and love at home

Full Story

LIFEHow to Decide on a New Town

These considerations will help you evaluate a region and a neighborhood, so you can make the right move

Full Story

UNIVERSAL DESIGN10 Questions to Ask Before Sharing Your Home With Aging Parents

Honest conversation is key to deciding whether it makes sense to have your parents move in with you

Full Story

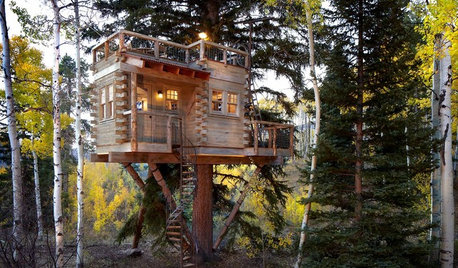

TREE HOUSESHouzz Call: Show Us Your Well-Designed Treehouse or Tree Fort!

Got a great treehouse or tree fort? We want to see it! Post yours in the Comments and we’ll feature the best in a future article

Full Story

LIFERetirement Reinvention: Boomers Plot Their Next Big Move

Choosing a place to settle in for the golden years? You're not alone. Where boomers are going and what it might look like

Full Story

sushipup1