New Construction - Closing Date Issue

Tara P

6 years ago

last modified: 6 years ago

Featured Answer

Sort by:Oldest

Comments (45)

cpartist

6 years agoRelated Discussions

How To Handle Issue With New Construction

Comments (13)chispa: "Why wouldn't you hire an inspector or PE to make sure that things are done properly at EACH stage?" Good in theory...but very hard to find one that is truly capable of performing such inspections in any way that is really worthwhile. Few if any P.E.'s and/or Home Inspectors are knowledgeable in all phases of construction code, and, they must be able to read blueprints. Without full code knowledge for that specific town or city, and without the ability to read blueprints, phase inspections are really not meaningful. P.E.'s are licensed in specific disciplines...that said, a structural engineer can phase inspect for the structural aspects, but won't have a clue about residential electrical or plumbing or HVAC code. One would need to hire an independent code inspector who is experienced in ALL code, which is also difficult because most specialize in only one or two disciplines ...and , most don't perform such private party inspections due to the liability involvedÂ.as when they work for the municipality, they are not personally liable. The best bet would probably be an architectÂas they have most of the skill set needed to do the jobÂbut again, due to the liability, few if any perform such inspectionsÂand, generally one does not become and architect simply to perform inspections of new construction. That established new home buyers should be VERY wary indeed of ANY inspector and/or engineer and/or contractor and/or code inspector who claims they do such inspections. Make certain that they have documented knowledge experience in ALL LOCAL code as well as the ability to read blueprints. Check references as wellÂ.AND, verify that they carry both liability and errors and omissions insurance. Last but not least...the time to do this is obviouly at the beginning...and with a clause built in to the purchase contract that the builder will not only allow such inspections...but will also rectify any violations or deficiencies found by the inspector. Getting a builder to agree to this may not be at all easy...but, I suppose in this market, the chance is a bit better....See MoreClosing date vs possession date

Comments (36)weedyacres, I think actual damage is less common, but happens. The removal of hardscape and landscape items have been reported (wasn't it in GW about the paved walkway being removed?), and other cases where the new owners found multiple holes in the ground where trees and shrubs had been dug up. Some have reported missing or switched appliances, light fixtures and other items that should have remained per the contract. Other annoyances abound, such as leaving items behind for the owner to clear out (hazardous waste products, large/heavy items requiring special disposal pick-up, etc.) discovering they painted around the furniture rather than behind it (another GWer's post), and damage hidden by furniture or rugs. In one local case, the previous owner's son refused to leave and it took a drawn out, and expensive, legal battle to remove him. It is bad enough having to deal with some of these issues when you become aware of them at a vacant house walkthrough. In our case, multiple cans of hazardous waste and multiple bulky items were left for us to take care of, but we were under time constraints and had to close rather than force the owners to remove the junk. I hate to imagine what they would have thought to get away with leaving if it had been had been after closing!...See MoreApprasial issues new home construction

Comments (16)When I checked into the tax situation, I found combining pins to lead to a small discount for total tax but not necessarily enough to be worth losing the flexibility to sell separately. Plus, combining parcels is only an option if you own them outright, otherwise you have to work with the lender and that might be much more cost than benefit. Combining and separating parcels can be troublesome and I wouldn't advise doing so if there was any possible expectation that the change would not be permanent. In fact, that is how I got into the situation originally. Previous owners had 3 adjacent properties, total just less than an acre. They had the bright idea to have the property resurveyed and to take parts of each lot and get a fourth buildable lot. The loans weren't modified but the county assigned new PINs. After the foreclosures, the property ended up with two PINs, one for house and garage, one for the back portion. I got tired of two tax bills and I had them recombined and saved a couple hundred bucks per year. Keeping the tax bills straight and making sure that each one gets paid is essential....See Morecrack in garage flooring (new construction closed 25 days ago)

Comments (5)Building on millworkman’s comment, epoxy will not prevent cracking. Generally score lines in the slab control and disguise crack locations but not always. We installed an inter-locking floating vinyl garage tile on ours....See MoreTara P

6 years agolast modified: 6 years agoTara P

6 years agolast modified: 6 years agobry911

6 years agolast modified: 6 years agobry911

6 years agolast modified: 6 years agoTara P

6 years agoTara P

6 years agolast modified: 6 years agocpartist

6 years agocpartist

6 years agobry911

6 years agoSherry8aNorthAL

6 years agocallisondesigner

6 years agohomechef59

6 years agoTara P

6 years agosunnydrew

6 years agosunnydrew

6 years agosunnydrew

6 years agohomechef59

6 years agosunnydrew

6 years agocpartist

6 years agolexma90

6 years agoMark Bischak, Architect

6 years agolast modified: 6 years agoTara P

6 years agoB Carey

6 years agoMark Bischak, Architect

6 years agolast modified: 6 years agooliviag55

6 years agooliviag55

6 years agocpartist

6 years agooliviag55

6 years agooliviag55

6 years agobry911

6 years agoDenita

6 years agoTara P

6 years agocpartist

6 years agocbear622

6 years agoTara P

6 years agohtwo82

6 years agoHU-341848245

2 years agomillworkman

2 years ago

Related Stories

DECORATING GUIDESUp Close: DIY Salvaged-Wood Wall

See how designer Garrison Hullinger made this unique wood wall covering

Full Story

REMODELING GUIDESConstruction Timelines: What to Know Before You Build

Learn the details of building schedules to lessen frustration, help your project go smoothly and prevent delays

Full Story

You Said It: Hot-Button Issues Fired Up the Comments This Week

Dust, window coverings, contemporary designs and more are inspiring lively conversations on Houzz

Full Story

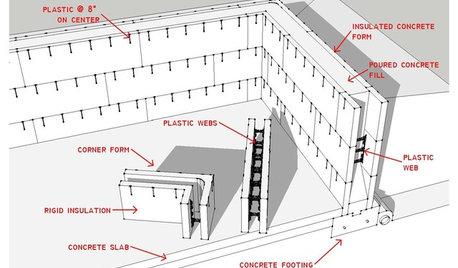

KNOW YOUR HOUSEKnow Your House: The Basics of Insulated Concrete Form Construction

Get peace and quiet inside and energy efficiency all around with this heavy-duty alternative to wood-frame construction

Full Story

WORKING WITH PROSYour Guide to a Smooth-Running Construction Project

Find out how to save time, money and your sanity when building new or remodeling

Full Story

BUDGETING YOUR PROJECTConstruction Contracts: What Are General Conditions?

Here’s what you should know about these behind-the-scenes costs and why your contractor bills for them

Full Story

KITCHEN DESIGNHave Your Open Kitchen and Close It Off Too

Get the best of both worlds with a kitchen that can hide or be in plain sight, thanks to doors, curtains and savvy design

Full Story

KITCHEN DESIGNOpen vs. Closed Kitchens — Which Style Works Best for You?

Get the kitchen layout that's right for you with this advice from 3 experts

Full Story

REMODELING GUIDESWhat to Consider Before Starting Construction

Reduce building hassles by learning how to vet general contractors and compare bids

Full Story

KITCHEN CABINETSCabinets 101: How to Choose Construction, Materials and Style

Do you want custom, semicustom or stock cabinets? Frameless or framed construction? We review the options

Full StorySponsored

Franklin County's Preferred Architectural Firm | Best of Houzz Winner

cpartist