Currency exchange and bank fees

Love stone homes

7 years ago

Featured Answer

Comments (39)

Love stone homes

7 years agoRelated Discussions

New Bank Says, 'Get Lost'

Comments (13)As for the 0.05% offered by the MB bank ... that's pre-tax income, don't forget. Plus ... one needs to shift part of current interest earnings over to the principal amount, in order to offset the erosion of value of each dollar-denominated invested dollar due to inflation. One of ole joyful's theme songs over the years of being a personal financial advisor, "What's better than putting your money into a bank? Buying a piece of the bank". Recently amended to, " ... buying a piece of a Canadian bank" ... better regulated. None of them have gone under ... or are about to. But the one in which I bought shares 42 years ago for about $4.20 and whose value had risen to $107. or so each in June '07 ... ... was exposed to the U.S. financial fiasco ... ... and after the fallout was finished (well, up till now, anyway) was down to about $40.00, late fall last year ... back to about $60.00 now. But pays about 30 times the rate of (tax-advantaged) dividend that it did when I bought it. And employment earnings, pensions (above a minimal deductible amount) and interest earnings are taxed at top rate, around here. How about buying a chunk of an oil well? Gold mine? When there's huge debt, and major deficit, plus bailouts, overhanging a currency, it's at some serious risk. And when the country fires up the printing presses to print more, that adds to the risk. Maybe move some assets offshore - but risky if to Canada, for when you guys get a sniffle ... we get pneumonia! ole joyful...See MoreThe Sub-prime Trump Card: Standing Up To The Banks

Comments (5)Is it any wonder why judges in several states are forcing banks and other lending providers to prove they own the properties in question? Wall Street girds for battle on accounting rules July 02, 2008 NEW YORK/WASHINGTON (Reuters)"In the middle of a credit crisis that only seems to get worse, Wall Street is mustering its lobbying clout to delay tougher accounting rules that would force banks to add $5 trillion to their balance sheets. For years, accounting standards allowed U.S. banks to keep certain loans, such as those linked to risky subprime mortgages, in off-balance sheet vehicles. But members of the Financial Accounting Standards Board (FASB), which sets U.S. accounting rules, have become convinced that approach hid the true risks banks faced from these vehicles, and that standards must be fundamentally altered. Under FASB's current thinking, analysts estimate financial institutions could be forced to book $5 trillion, which would most likely include troubled loans. That would skew capital ratios, force banks to stash away cash to offset their risks, and hit their liquidity at the worst possible time. "These drastic measures are being rushed and could single-handedly erase the efforts of policymakers to provide stability and restore liquidity to our markets," said Brendan Reilly, senior vice president with the Commercial Mortgage Securities Assn. "Any changes must be delayed until all options and consequences are carefully examined," he said. However, under direction of the Securities and Exchange Commission, FASB must revamp the accounting standard, known as FAS 140, by 2009. It could release a proposal on the new rule in the next few months....See MoreBanking

Comments (32)I too love our little credit union. Like Fran, it's fee free, we never pay a cent for anything and only a 5.00 share account balance is required. They have friendly service, a great website experience, an easy banking app and we can get money for free from any Credit Union ATM anywhere in the US. Most importantly, when our account was wiped out by a thief who stole my atm number, they were very kind to us and had the funds returned immediately without any additional stress. We've been with them for 10 years now and have no intent on ever leaving. I agree too that anyone not satisfied with the service they get should shop around for something new. There are so many options....See MoreExchanging coins for cash

Comments (35)We rarely need cash, but keep a few small bills on hand. I've had the same two bills in my purse forever, along with a couple of quarters. IDK why anyone *needs* ATM machines. Is it so hard to anticipate needing cash? Will you miss the teeny profit not invested? Even with inflation, the convenience is worth it. Everything goes on one or two CC's at our house. The bank issuing one card refunds a percentage on charges. This month we were owed something like $99.78, and the bank rounded it up (for their convenience) before applying it to our next statement. I see that banks are calling a halt to overdraft fees after federal regulators cracked down. The story I read said Wells Fargo made a million dollars on these last year! Are people daft, not to know how much they have in a checking account? Evidently banks would charge a flat amount (like $30) on each overdraft, so banks would process large amounts first, resulting in overdraft fees on each of several smaller checks. (That would happen to me ONCE.) Post Brexit, can I cash two old travelers checks for twenty pounds each?...See MoreLove stone homes

7 years agolast modified: 7 years agoLove stone homes

7 years agolast modified: 7 years agoLove stone homes

7 years agoLove stone homes

7 years agoLove stone homes

7 years agoLove stone homes

7 years agoLove stone homes

7 years agolast modified: 7 years agoLove stone homes

7 years agoLove stone homes

7 years agolast modified: 7 years agojoyfulguy

7 years agoLove stone homes

7 years agoLove stone homes

7 years agoLove stone homes

7 years agoLove stone homes

7 years ago

Related Stories

REMODELING GUIDESYou Won't Believe What These Homeowners Found in Their Walls

From the banal to the downright bizarre, these uncovered artifacts may get you wondering what may be hidden in your own home

Full Story

WORKING WITH PROS12 Questions Your Interior Designer Should Ask You

The best decorators aren’t dictators — and they’re not mind readers either. To understand your tastes, they need this essential info

Full Story

BUDGETING YOUR PROJECTDesign Workshop: Is a Phased Construction Project Right for You?

Breaking up your remodel or custom home project has benefits and disadvantages. See if it’s right for you

Full Story

GREEN BUILDINGHouzz Tour: Going Completely Off the Grid in Nova Scotia

Powered by sunshine and built with salvaged materials, this Canadian home is an experiment for green building practices

Full Story

FEEL-GOOD HOMESimple Pleasures: 10 Ideas for a Buy-Less Month

Save money without feeling pinched by taking advantage of free resources and your own ingenuity

Full Story

HOUZZ TOURSA New Community Flourishes in Rhode Island

Innovative affordable housing project offers new ideas for living with agriculture, art and each other

Full Story

REMODELING GUIDESOne Guy Found a $175,000 Comic in His Wall. What Has Your Home Hidden?

Have you found a treasure, large or small, when remodeling your house? We want to see it!

Full Story

DECLUTTERINGDownsizing Help: How to Get Rid of Your Extra Stuff

Sell, consign, donate? We walk you through the options so you can sail through scaling down

Full Story

BEFORE AND AFTERSHouzz Tour: A Georgia Foreclosure Gets a Major Overhaul

Gutting and redesigning turn a mishmash 1925 home into a unified haven with better flow

Full Story

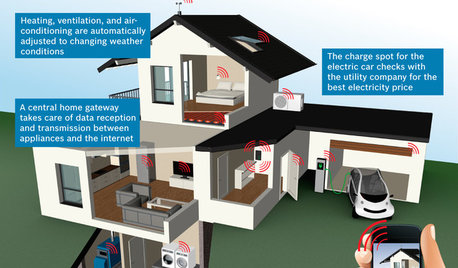

THE HARDWORKING HOMECES 2015: Inching Toward a Smarter Home

Companies are betting big on connected devices in 2015. Here’s a look at what’s to come

Full StorySponsored

More Discussions

jrb451