mortgages and change in employment status

splinky

16 years ago

Related Stories

HOUZZ TOURSHouzz Tour: Major Changes Open Up a Seattle Waterfront Home

Taken down to the shell, this Tudor-Craftsman blend now maximizes island views, flow and outdoor connections

Full Story

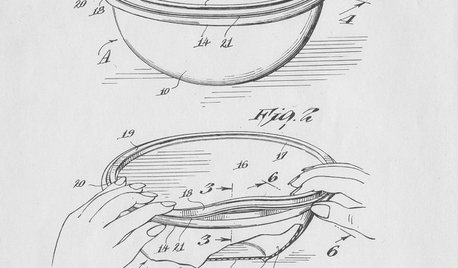

FEATURESHow Tupperware’s Inventor Left a Legacy That’s Anything but Airtight

Earl S. Tupper — and his trailblazing marketing guru, Brownie Wise — forever changed food storage. His story is stranger than fiction

Full Story

LIGHTINGWhat to Know About Switching to LED Lightbulbs

If you’ve been thinking about changing over to LEDs but aren't sure how to do it and which to buy, this story is for you

Full Story

SMALL SPACESLife Lessons From 10 Years of Living in 84 Square Feet

Dee Williams was looking for a richer life. She found it by moving into a very tiny house

Full Story

MY HOUZZHouzz TV: A Couple’s Garage Becomes Their Chic New Home

Portland, Oregon, homeowners find freedom in a city-approved garage home with DIY industrial flair

Full Story

ENTRYWAYSGrand Entry Elements: Newel Posts Past and Present

They once spoke to wealth and class, but newel posts today say more about individual style

Full Story

MOST POPULARA First-Time Buyer’s Guide to Home Maintenance

Take care of these tasks to avoid major home hassles, inefficiencies or unsightliness down the road

Full Story

LIGHTINGHouse Hunting? Look Carefully at the Light

Consider windows, skylights and the sun in any potential home, lest you end up facing down the dark

Full Story

FURNITUREObjects of Desire: New Takes on the Tufted Sofa

From curving round a bend to rolling with steampunk, these decidedly different chesterfields fit more than traditional settings

Full Story

DECORATING GUIDESMicro Design: Neat Little Niches

Turn that cubby into a mini gallery for art, flowers or curated storage

Full Story

davidandkasie

splinkyOriginal Author

Related Discussions

Mortgage Meltdown - ABC News

Q

Qualifying for a mortgage

Q

A NEW Problem With My Buyer--Now The Mortgage

Q

A Clean & Sober Mortgage System

Q

novahomesick

splinkyOriginal Author

terezosa / terriks

splinkyOriginal Author

terezosa / terriks

splinkyOriginal Author

granite_grrl

splinkyOriginal Author

mzdee

splinkyOriginal Author

pamghatten

splinkyOriginal Author