Do we need to get married to qualify for a conventional loan???

TOTALN00B

13 years ago

Related Stories

HOUZZ TOURSDiscover a Hobbit House Fit for Bilbo Baggins

Part art studio, part guesthouse and all charm, this imaginative Colorado cottage looks like it grew right out of the earth

Full Story

LIFE12 House-Hunting Tips to Help You Make the Right Choice

Stay organized and focused on your quest for a new home, to make the search easier and avoid surprises later

Full Story

DECORATING GUIDESCalifornia Law: License to Practice Interior Design?

A proposed bill that would require a license to practice interior design in California has Houzzers talking. Where do you stand?

Full Story

DECORATING GUIDESBudget Decorator: Let’s Go Thrifting

Dip into the treasure trove of secondhand pieces for decor that shows your resourcefulness as much as your personality

Full Story

MOST POPULARBudget Decorator: Shop Your Home for a New Look

Redecorate without spending a cent by casting a creative eye on the showroom called home

Full Story

HOW TO PHOTOGRAPH YOUR HOUSEAttract Home Buyers Easily With Great Photography

Show your home's best face in real estate listing photos to have potential buyers knocking down your door

Full Story

SMALL SPACESCould You Live in a Tiny House?

Here are 10 things to consider if you’re thinking of downsizing — way down

Full Story

HOUSEKEEPINGWhen You Need Real Housekeeping Help

Which is scarier, Lifetime's 'Devious Maids' show or that area behind the toilet? If the toilet wins, you'll need these tips

Full Story

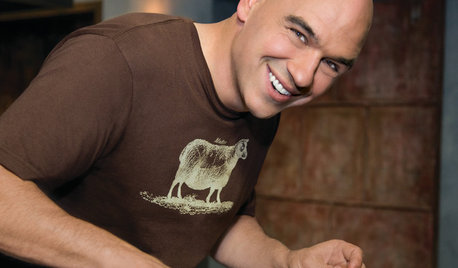

TASTEMAKERSPro Chefs Dish on Kitchens: Michael Symon Shares His Tastes

What does an Iron Chef go for in kitchen layout, appliances and lighting? Find out here

Full Story

MATERIALSInsulation Basics: What to Know About Spray Foam

Learn what exactly spray foam is, the pros and cons of using it and why you shouldn’t mess around with installation

Full Story

kudzu9

Billl

Related Discussions

Getting married starting off in debt

Q

how long do you have to be in a home to get an equity loan?

Q

Do we need a new realtor?

Q

*BAD* College Loans - need advice for a friend

Q

weedyacres

badgergrrl

TOTALN00BOriginal Author

brickeyee

marie_ndcal

brickeyee

badgergrrl

pamghatten

brickeyee

sweet_tea

badgergrrl