Can anyone explain..?

logic

16 years ago

Related Stories

COMMUNITYCommunity Building Just About Anyone Can Do

Strengthen neighborhoods and pride of place by setting up more public spaces — even small, temporary ones can make a big difference

Full Story

KITCHEN DESIGNThe Cure for Houzz Envy: Kitchen Touches Anyone Can Do

Take your kitchen up a notch even if it will never reach top-of-the-line, with these cheap and easy decorating ideas

Full Story

LAUNDRY ROOMSThe Cure for Houzz Envy: Laundry Room Touches Anyone Can Do

Make fluffing and folding more enjoyable by borrowing these ideas from beautifully designed laundry rooms

Full Story

BUDGET DECORATINGThe Cure for Houzz Envy: Living Room Touches Anyone Can Do

Spiff up your living room with very little effort or expense, using ideas borrowed from covetable ones

Full Story

KITCHEN DESIGNKitchen Banquettes: Explaining the Buffet of Options

We dish up info on all your choices — shapes, materials, storage types — so you can choose the banquette that suits your kitchen best

Full Story

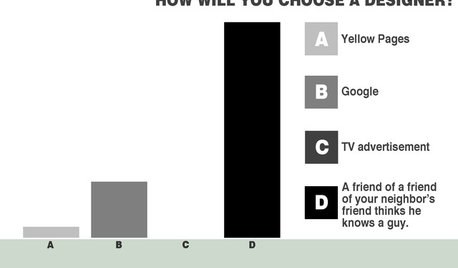

COFFEE WITH AN ARCHITECTHitting the Bars to Explain the Design Process

Simple bar charts and a little math by a seasoned architect give a helpful overview of renovation and new-build proceedings

Full Story

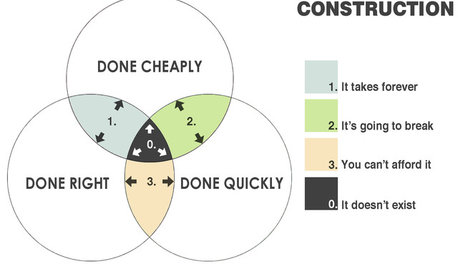

COFFEE WITH AN ARCHITECTThe Elements of Design Explained With Venn Diagrams

Design doesn't have to be hard to understand. It just needs the right presentation

Full Story

DECORATING GUIDES7 Bedroom Styling Tricks Anyone Can Do

Short on time or money? You can spruce up your bedroom quickly and easily with these tips

Full Story

KITCHEN DESIGN6 Clever Kitchen Storage Ideas Anyone Can Use

No pantry, small kitchen, cabinet shortage ... whatever your storage or organizing dilemma, one of these ideas can help

Full Story

MUDROOMSThe Cure for Houzz Envy: Mudroom Touches Anyone Can Do

Make a utilitarian mudroom snazzier and better organized with these cheap and easy ideas

Full Story

cheapheap

dave_donhoff

Related Discussions

can anyone explain this bluejay behavior?

Q

Can anyone explain this new Toaster oven to me

Q

Can anyone explain this bird behavior?

Q

Can anyone explain this? Salvia Hybrid...

Q

mfbenson

logicOriginal Author

bethesdamadman

feedingfrenzy

docholiday

mfbenson

logicOriginal Author

docholiday

logicOriginal Author

feedingfrenzy

mfbenson

logicOriginal Author

docholiday

housenewbie

mfbenson

logicOriginal Author

talley_sue_nyc

dave_donhoff

housenewbie

logicOriginal Author