Kitchen remodel only 15% of home value?!?

Adrienne2011

13 years ago

Featured Answer

Sort by:Oldest

Comments (36)

Adrienne2011

13 years agolast modified: 9 years agohoneysucklevine

13 years agolast modified: 9 years agoRelated Discussions

Resale value if removing only bathtub and replacing with shower

Comments (27)I was going to suggest the same as juliekcmo. Rip out the tub, cap off unused plumbing so a tub can easily be put back in. Don't get one of those big solid shower units, use tile and keep plenty of extra (and grout!) 'just in case'. You're going to have to think about a shower door... that's actually a bigger decision. Do you want to spend the money on a nice frameless one (would appeal to buyer that doesn't mind not having a tub) or do you just use a curtain? (would appeal to someone that's going to put in a tub-less tile to repair). Ripping out the bottom of the shower and plopping down a tub won't be a deal breaker if a prospective buyer loves the house in every other way. I wouldn't offer an allowance right away unless they asked for it or I would use it in a counter offer. Your realtor will give you feedback-it might be necessary to offer it right off the bat....See MoreAre u doing kitchen remodel as part of whole house remodel?

Comments (18)This is a story of what you should NOT do with your house. Bought a tiny 2 bedroom 1950s ranch in 1989. Added a floor and put the living, dining and kitchen on the top floor. It gave us a view of the mountains and the lake. Garage in the basement was incorporated into the basement floor space. Built a detached garage in 1997 to augment the garage that was lacking. Tried to see if we can move up in the neighborhood. Could not afford the comparable view and did not want to give it up. So we brought the middle floor to the stud and reconfigured it for 3 bedroom and 2 bath in 2002. (previously only 1 bath and very knarly floor plan which was inherited from the original house.) Finished the basement with a media room, infloor heating, trim to match the rest of the house etc. Fast forward another few years... We still cannot afford the view in the slightly better neighborhood any other way. (The upcharge is about 1/2 to 1 mil.) We looked at many houses recently! I recently saw a beautiful house that was done very well. But there was no view from the kitchen or the dining room. Saw another house that had a view from the living room only. We are not in the living room until it is dark outside! We would lose our breakfast with sunrise over the mountains. This was the usual story of all the houses that we looked at. At the comparable price point, the houses have the view from the bedroom, not from the kitchen or the living space. Because we have the ususual space arrangement of living/kitchen/dining floor at the top, we have the view from the rooms we use everyday as a family. This is unusual but gives us a very open space with 180 degree view. We are now embarking on a kitchen remodel of the kitchen that was put in 1989/1990. The kitchen was done on a budget and is not at the level of the quality that we have updated the rest of the house. So we are actually the other way around. Whole house remodel first and back to the kitchen which is 20 years old. In the end, we have the house that we want to live in. Had we not done this and lived with what is there or moved to another house and given up a few things, ie view, open living configuration, natural light etc, we would be way ahead in the money! Oh well, you can't take it with you......See MoreWhat % of your house value did you spend on your kitchen remodel?

Comments (90)@Janie it's a funny disparity, but my husband drives home from work every day in his $3700 car, wearing a $7000 watch (company gift for length of service) and when our kitchen is finally finished, he will walk in and make himself a coffee on a machine that doesn't cost a car payment, it cost almost as much as the CAR. Our total expense, hopefully around $30k, will be a title less than 15% of the current value of our home. We're in the Houston burbs, so pretty low COL. Ours is mostly DIY, but wth lots of structural changes. We put about 1/3 of our budget in plumbing and electrical. We knew the espresso setup would be $3k. And I knew I wanted 2 ovens and Marmoleum for the floor. We worked everything else around that, including getting our cabinets from Craigslist and then 16' of counter from ikea clearance for under $100 We got married in our backyard, my youngest daughter was born upstairs, and we love the neighborhood and neighbors and schools and we're about 15 minutes from most of my family. Unless we have to relocate, we're not going anywhere. We used the 15% number as a guide to not overimorive for the neighborhood. I wouldn't have thought a minimum was really applicableto any kitchen though. Because there's so much variation in what needs to be done. Some kitchens might need new counters and a coat of paint. Ours required rebuilding 3 load bearing walls....See MoreInsulation Value R13 versus R15

Comments (9)L S if the contract states R15 you should be getting R15 simple as that. My most recent house I did had a mix of R15 and R13 due to budget reasons. Trying to finish the house under 100k including land. Speaking of budget your contractor is trying to save money by using lesser insulation and the staple part, I FIRED a guy of my previous job because he did that. The crazy thing was after I pointed it out to him he said not to worry that he seen it done worse. He got FIRED and never came back. As for the R15 insulation it is a little better true, it also has a side benefit that people don't talk about but it matters to me, it mutters the noise better and the house feels solid and quiet. Here is a shameless plug for my video :-) I talk about the insulation and price of it as well so you get an idea. Last thing get the insulation you agreed on it makes a difference. P.S. I also used Hardie siding....See Morerosie

13 years agolast modified: 9 years agosteff_1

13 years agolast modified: 9 years agopalimpsest

13 years agolast modified: 9 years agoaloha2009

13 years agolast modified: 9 years agomountaineergirl

13 years agolast modified: 9 years agoblfenton

13 years agolast modified: 9 years agoformerlyflorantha

13 years agolast modified: 9 years agosteff_1

13 years agolast modified: 9 years agodaveinorlado

13 years agolast modified: 9 years agoAdrienne2011

13 years agolast modified: 9 years agosteff_1

13 years agolast modified: 9 years agodianalo

13 years agolast modified: 9 years agohoneysucklevine

13 years agolast modified: 9 years agokathec

13 years agolast modified: 9 years agosayde

13 years agolast modified: 9 years agodoonie

13 years agolast modified: 9 years agoshortyrobyn

13 years agolast modified: 9 years agoformerlyflorantha

13 years agolast modified: 9 years agofunction_first

13 years agolive_wire_oak

13 years agolast modified: 9 years agoideagirl2

13 years agolast modified: 9 years agosteff_1

13 years agolast modified: 9 years agoformerlyflorantha

13 years agolast modified: 9 years agodoonie

13 years agolast modified: 9 years agoantss

13 years agolast modified: 9 years agodoonie

13 years agolast modified: 9 years agoshortyrobyn

13 years agolast modified: 9 years agopalimpsest

13 years agolast modified: 9 years agoAdrienne2011

13 years agolast modified: 9 years agodoonie

13 years agolast modified: 9 years agoformerlyflorantha

12 years agolast modified: 9 years agocaliforniagirl

10 years agolast modified: 9 years agolam702

10 years agolast modified: 9 years ago

Related Stories

MOST POPULAR5 Remodels That Make Good Resale Value Sense — and 5 That Don’t

Find out which projects offer the best return on your investment dollars

Full Story

SELLING YOUR HOUSE10 Ways to Boost Your Home's Resale Value

Figure out which renovations will pay off, and you'll have more money in your pocket when that 'Sold' sign is hung

Full Story

GREEN BUILDINGInsulation Basics: Heat, R-Value and the Building Envelope

Learn how heat moves through a home and the materials that can stop it, to make sure your insulation is as effective as you think

Full Story

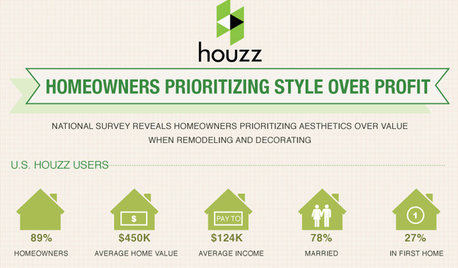

Houzz Survey: Livability Trumps Home Value

Increasing home value comes in a distant second among those planning home improvements. Many plan to do some of the work themselves

Full Story

REMODELING GUIDESConsidering a Fixer-Upper? 15 Questions to Ask First

Learn about the hidden costs and treasures of older homes to avoid budget surprises and accidentally tossing valuable features

Full Story

RANCH HOMESHouzz Tour: Budget Remodel for a Midcentury Oregon Rancho

With help from friends, an interior designer and her husband refresh an efficient, timeless home in Portland for $15,000

Full Story

MOST POPULAR15 Remodeling ‘Uh-Oh’ Moments to Learn From

The road to successful design is paved with disaster stories. What’s yours?

Full Story

BATHROOM DESIGNSee 2 DIY Bathroom Remodels for $15,500

A little Internet savvy allowed this couple to remodel 2 bathrooms in their Oregon bungalow

Full Story

BATHROOM DESIGN14 Design Tips to Know Before Remodeling Your Bathroom

Learn a few tried and true design tricks to prevent headaches during your next bathroom project

Full Story

INSIDE HOUZZHouzz Survey: See the Latest Benchmarks on Remodeling Costs and More

The annual Houzz & Home survey reveals what you can expect to pay for a renovation project and how long it may take

Full Story

User