The College Credit-Card Hustle

turnage (8a TX)

15 years ago

Related Stories

DECORATING GUIDES9 Planning Musts Before You Start a Makeover

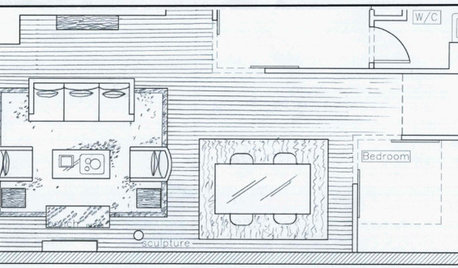

Don’t buy even a single chair without measuring and mapping, and you’ll be sitting pretty when your new room is done

Full Story

MOST POPULAROrganizing? Don’t Forget the Essential First Step

Simplify the process of getting your home in order by taking it one step at a time. Here’s how to get on the right path

Full Story

MOST POPULARThe Not Naturally Organized Parent's Guide to the Holidays

This year get real about what you can and cannot handle, and remember the joys of spending time with the ones you love

Full Story

HOLIDAYSChristmas Cleanup Tips for the Not Naturally Organized

Dreading the postholiday chores? First let yourself unwind. Then grab some boxes, a few supplies and this easy guide

Full Story

ORGANIZINGWant to Streamline Your Life? Get a System

Reduce stress and free up more time for the things that really matter by establishing specific procedures for everyday tasks

Full Story

HOLIDAYS8 Ways to Really Slow Down and Savor the Holidays

Running amok to fit in holiday tasks can leave you frazzled and unfulfilled. Here's how to focus on what you enjoy most

Full Story

FEEL-GOOD HOMESimple Pleasures: 10 Ideas for a Buy-Less Month

Save money without feeling pinched by taking advantage of free resources and your own ingenuity

Full StorySponsored

More Discussions

dreamgarden

western_pa_luann

Related Discussions

Anyone experiencing this with credit card companies?

Q

Credit Scores Hit by Card Limits

Q

Does Facebook track my credit card?

Q

Contact free credit cards

Q

joyfulguy

dreamgarden

triciae

Meghane

dreamgarden

western_pa_luann

triciae

dreamgarden

triciae

harriethomeowner

dreamgarden

dreamgarden

harriethomeowner

bethesdamadman

dreamgarden

dreamgarden

bethesdamadman

devorah

greg_h

devorah

jakkom

rileysmom17

greg_h

dreamgarden

greg_h

kframe19