Canadians: Income -about $40,000.00 ... -Income Tax ... $0.00

joyfulguy

17 years ago

Related Stories

GREEN BUILDINGLet’s Clear Up Some Confusion About Solar Panels

Different panel types do different things. If you want solar energy for your home, get the basics here first

Full Story

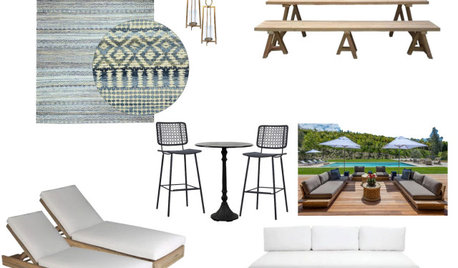

WORKING WITH PROS10 Things Decorators Want You to Know About What They Do

They do more than pick pretty colors. Here's what decorators can do for you — and how you can help them

Full Story

FUN HOUZZEverything I Need to Know About Decorating I Learned from Downton Abbey

Mind your manors with these 10 decorating tips from the PBS series, returning on January 5

Full Story

REMODELING GUIDESDesign Workshop: Is an In-Law Unit Right for Your Property?

ADUs can alleviate suburban sprawl, add rental income for homeowners, create affordable housing and much more

Full Story

MOST POPULARWhat to Know About Adding a Deck

Want to increase your living space outside? Learn the requirements, costs and other considerations for building a deck

Full Story

GREEN BUILDINGWhat's LEED All About, Anyway?

If you're looking for a sustainable, energy-efficient home, look into LEED certification. Learn about the program and its rating system here

Full Story

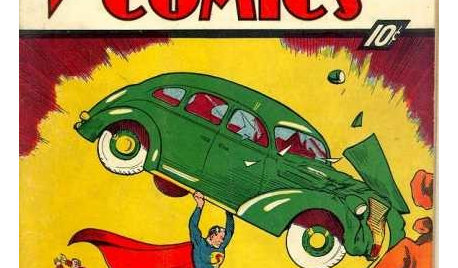

REMODELING GUIDESOne Guy Found a $175,000 Comic in His Wall. What Has Your Home Hidden?

Have you found a treasure, large or small, when remodeling your house? We want to see it!

Full Story

GREEN BUILDINGHouzz Tour: See a Concrete House With a $0 Energy Bill

Passive House principles and universal design elements result in a home that’ll work efficiently for the long haul

Full Story

KITCHEN DESIGNKitchen Remodel Costs: 3 Budgets, 3 Kitchens

What you can expect from a kitchen remodel with a budget from $20,000 to $100,000

Full StoryMore Discussions

bushleague

joyfulguyOriginal Author

joyfulguyOriginal Author