Form 5695 Residential energy Credit - do I qualify?

shawneeks

16 years ago

Related Stories

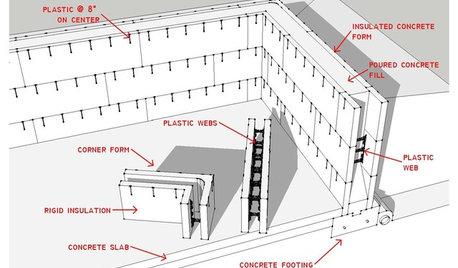

KNOW YOUR HOUSEKnow Your House: The Basics of Insulated Concrete Form Construction

Get peace and quiet inside and energy efficiency all around with this heavy-duty alternative to wood-frame construction

Full Story

GREEN BUILDINGHouzz Tour: See a Maine House With a $240 Annual Energy Bill

Airtight and powered by the sun, this energy-efficient home in a cold-winter climate is an architectural feat

Full Story

MOVINGHiring a Home Inspector? Ask These 10 Questions

How to make sure the pro who performs your home inspection is properly qualified and insured, so you can protect your big investment

Full Story

GREEN BUILDINGLet’s Clear Up Some Confusion About Solar Panels

Different panel types do different things. If you want solar energy for your home, get the basics here first

Full Story

ARCHITECTURE5 Midcentury Design Lessons for Modern-Day Living

The era’s simple and economical materials and open, energy-smart floor plans still have relevance today. See why

Full Story

GREEN BUILDINGWhat's LEED All About, Anyway?

If you're looking for a sustainable, energy-efficient home, look into LEED certification. Learn about the program and its rating system here

Full Story

GREEN BUILDINGHouzz Tour: Passive House Principles, Active Benefits in Portland

Lower energy bills and consistent temperatures are just two of the advantages of this architect’s newly built home

Full Story

GREAT HOME PROJECTSHow to Switch to a Tankless Water Heater

New project for a new year: Swap your conventional heater for an energy-saving model — and don’t be fooled by misinformation

Full Story

KITCHEN DESIGNHow to Set Up a Kitchen Work Triangle

Efficiently designing the path connecting your sink, range and refrigerator can save time and energy in the kitchen

Full Story

GREEN BUILDINGOff the Grid: Ready to Pull the Plug on City Power?

What to consider if you want to stop relying on public utilities — or just have a more energy-efficient home

Full Story

mightyanvil

shawneeksOriginal Author

Related Discussions

Solar energy in CA., worth it?

Q

Energy Star certification questions

Q

HR 2454/2998 Important Energy Bill affecting owners/builders

Q

tax credit for solar heat collector

Q

shawneeksOriginal Author

mightyanvil